Excess Demand Function:

Define the excess demand function

Xi's are demand functions for the ith individual. Making use of this notation, the equilibrium conditions can be written as This condition states that at the equilibrium prices, excess demand is to be equal to zero in all markets. Two interesting results immediately follow:

1) If there is equilibrium in the market for n-l ..... then in Walrasian equilibrium, the remaining market will also be in equilibrium.

2) One can only solve for the relative prices in the model. Attempts to solve for absolute prices require adoption of normalisation. This would involve making additional assumption of one of the prices is equal to 1.

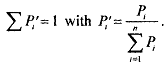

Another form of commonly employed normalisation is to assume that

Several interesting features emerge from such a formulation:

1) The aggregate excess demand functions (and demand functions) is homogenous of degree zero in all prices. That is to say, if all prices were to double, the quantity demanded of every good would remain unchanged.

2) Demand functions are continuous. If prices were to change by only a small amount, quantities demanded would change by only small amount.

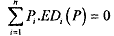

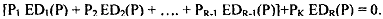

3) n excess demand functions are not independent of one another and the equations are related by the formula,

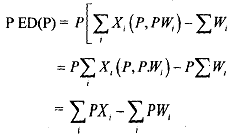

This formulation is called Walrus' Law. It states that the total value of excess demand is zero at any set of prices. There can be neither excess demand for all goods together nor excess supply. To prove this, take

4) If for some price system P, we get all prices to be strictly positive and (k-1) markets clear, then the kth market also clears.

By Walras' law we have

If the first k-1 markets clear, than  If

If

i.e., the kth market also clears.

i.e., the kth market also clears.

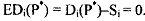

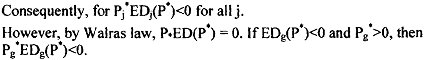

5) If a commodity is in excess supply in Walrasian equilibrium, then its price must be zero in equilibrium. That is, if (P*, x*) is a WE and ED,(P*)<o, then Pi= 0.

Proof: Since (P*, x*) is a WE,

We will have P*ED(P*)<O as all other terms P;ED,(P*)<o. This Contradicts the Walras law.