Labour Mobility:

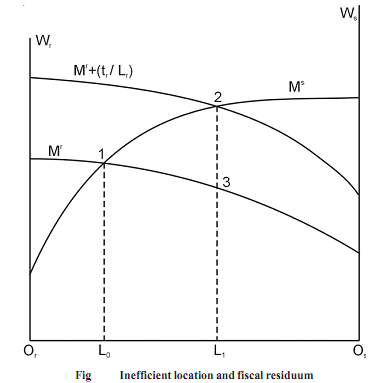

With labour mobility, inefficiency can arise from fiscal spending in different localities. To attain efficiency, it would be expected that factors of production would be allocated so that their marginal products would be equal. Here, it is possible to illustrate how different fiscal residua create inefficiency when labour is mobile. Assume that R is a high-income locality and S is a low-income locality. In Figure the wage rates for labour in the two localities are shown on the vertical axis. The marginal value product of labour in the two locations is illustrated by Mr and Ms , respectively.

The total supply of labour is down by the distance on the horizontal axis, if initially there is an efficient allocation of resources, then Or L0 labour is in locality R and Os L0 is in locality S. At this point the marginal products of labour are identical at point 1 in the two localities (assuming that wages are set equal to marginal value product).

Now suppose that in locality R revenue can be raised from resource taxes t r (e.g. taxes on land) and that this is available to be shared by the resident population l r . In S (now the 'poor' locality) there is no such revenue. In the figure Mr + (tr / lr) is the wage rate (the 'social' wage, i.e.

inclusive of the marginal value product and the fiscal residuum) and there is migration from R to S to the extent of L0 L1 , leading to an output loss measured by triangle 123. Unless there is any redress to this distortion, the marginal products of labour will not be equal. While the higher wage rate compensates the marginal worker for the lack of amenities in S, there is an equilibrium where the marginal products of labour are no longer equal. In this way output is lower than it would otherwise be and there is an 'efficiency' cost in terms of this output loss.