Richard Goodwin:

Richard Goodwin developed the Marxian conception that the power of the working class varies inversely with the size of the reserve army of labour. A militant working class will agitate for and succeed in gaining an increasing share of wages in income. However, the rise in wages has an adverse effect on the rate of accumulation and thereby on the employment rate. A cycle is generated by the interaction between the reserve army of labour, the distribution of income and the rate of accumulation. Class conflict, thus, is homeostatic and distributive shares remain more or less constant over the long run.

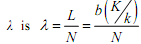

Goodwin invoked a predator-prey model involving distributive conflict between capitalists and workers. He assumed full utilization of capacity and investment determined by savings. The following account is drawn from Lance Taylor's text referred to in Section 11.7. Let , X K κ = with κ as the capital-output ratio. The symbol X stands for real output, a measure of production inclusive of intermediate inputs and K stands for the aggregate capital stock. The employed labour force is . bX L = Let the total population be denoted by N and the growth rate of N is n. The employment ratio  The wage share is ψ and on the assumption that all profits are saved, the growth rate g of the capital stock becomes

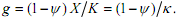

The wage share is ψ and on the assumption that all profits are saved, the growth rate g of the capital stock becomes

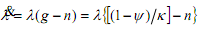

In the long run, the growth in the employment ratio is a function of the growth in output and employment, dots on variables denoting time derivatives

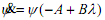

Along the Phillips curve lines ( to be discussed in Block 6), the wage share is assumed to rise in response to the employment ratio

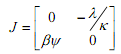

At a stationary point  the Jacobian of the above system takes the form

the Jacobian of the above system takes the form

The two state variables dampen fluctuations in one another with no intrinsic dynamics of their own. They chase each other around a closed orbit in the (λ,ψ) plane which encircles the stationary point (λ*, ψ*). The workers are the predators since the labour share rises with λ. Economic activity and employment are the prey since a higher value of ψ squeezes profits and reduces accumulation and growth. The literature developing Goodwin's insight has developed his idea that class struggle takes place in the labour market. Investment is an accommodating variable which adapts to the flow of saving. Saving is determined by income distribution which is determined in the labour market. The weakness of his model (and the strength of Kalecki's as we will see later in the next Section) is paying no attention to effective demand problems or, in Marx's terms, the realisation problem. Relatedly, Goodwin's models are classics in the genre of completely real dynamical systems in which money and finance play no role. From a financial perspective, it might be felt that the conflict between workers and capitalists is misspecified. Rentiers are owners of capital and the stock market needs to figure in any analytical description of a financially complex economy. The traditional class conflict might apply to the conflict between workers and the managers of firms. Besides, the parameters that generate Goodwin-type and real models are 'slow-moving'. The pace of changes in variables such as real wages, and their inverse profits, is slow. The effective labour force that feeds the reserve army grows steadily over time. These models cannot explain the manias, panics, and crashes, to use the evocative title of Charles Kindlelberger's remarkable precursor to the next section, that distinguish the ebb and flow of activity in a modern capitalist economy.