Fallacious argument for TT deterioration:

LDCs they result in lower prices as primary goods markets are perfectly competitive. So as productivity increases constantly, the net barter terms of trade (NBTT) of primary products would deteriorate constantly. But this conclusion does not follow so simply or as stated. The NBTT is a ratio of two money prices. Fixing one will cause the other to adjust to it at the market clearing relative price. It, therefore, doesn't follow that fixing one price necessarily implies a deterioration in the terms of trade.

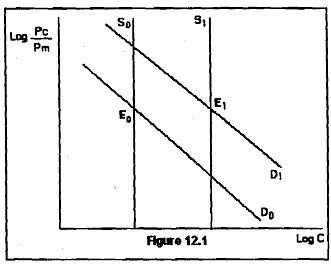

To see this, we develop a simple model. We assume two regions each specialised in production of one good. There is constant employment in each region and labour immobility between nations, and costless technical progress. We assume equal produlctivity growth in both regions, and unit income elasticity of demand for both products. We also assume wages are proportional to value added per worker so that the share of wages in national income is constant. We also assume macroeconomic equilibrium.

Suppose there is constant productivity growth in both primary commodities, C, and manufactures, M. Suppose NBTT ( P = Pc/Pm)X is at the market clearing value. Now because of technical change, the output of both C and M will increase by the same proportion and, therefore, so will world income. Since income elasticities of demand are all unity, demand for C and M will also increase by the same proportion and the market for both will just clear at the previous relative price. The unchanged relative price is sustainable and there is obviously no deterioration of the NBTT.

Suppose response is asymmetrical along Prebisch-Singer lines. In the North, money wages rise in pmpo~onto productivity in

manufactures so thqt Pm does not change. But PC falls by the same percentage as increase in productivity. The NBTT have deteriorated. But the market will not clear. There is excess supply of manufactures and excess demand for commodities as price of commodities has fallen and that of manufactures risen relatively. One solution is for manufacturing output and employment to fa. In this case, fall in NBTT will persist. But this is not proposed as a serious scenario. Another is for the increase in productivity to raise output of primary commodities, a case we examine later. The only other plausible market clearing mechanism is for PC to rise as Pm cannot change, and it will keep onlrising till the earlier NBTT is restored.

The original NBTT depended on a particular degree of monopoly power in manufacturing. As long as the degree of-monopoly power does not change, there will be no effect on NBTT. And there is no plausible reason to assume a continuously increasing monopoly power in manufactures.