Definitions of the terms of trade:

Since the development of the controversy in the 1950s, the concept of terms of trade is under careful scrutiny and several specifications and complementary to denote the ratios between the values of one commodity basket in tenns of another. These values, however, can be defined, measured and aggregated in many ways.

To put it straight, in international trade, terms of trade are the ratio of the price of an export commodity(ies) to the price of an import commodity(ies). "Terns of trade" are sometimes used as a proxy for the relative social welfare of a country, but this is technically questionable and should be used with extreme caution. An improvement in a nation's terms of trade is good for that country because it has to pay less for the products it imports. In other words, it has to give up less exports for the imports it receives.

In a simplified case of two countries and two commodities, terms of trade is defined as the ratio of the price a country must receive for its export commodity to the price it pays for its import commodity. In this simple case the imports of one country are the exports of the other country. For example, if a country exports 200 dollars worth of export product in exchange for 100

dollars worth of imported product. The country's terms of trade are 200/100 = 2. The terms of trade for the other country must be the reciprocal (100/200 = .5). When this number is falling, the country is said to have "deteriorating terms of trade". If multiplied by 100, these calculations can be expressed as a percent (200% and 50% respectively). If a country's terms of trade fall from say 1 00% to 70% (from 1.0 to .7), it has experienced a 30% deterioration in its terms of trade.

In case of the terms of trade, there are number of concepts that alternatively emerge. These concepts fall into two groups: those that relate to exchange ratios between commodities and those that relate to exchange between productive resources.

1) The basic concept is that of the Net Barter Terms of Trade (NBTT). This refers to the price of exports to the price of imports, namely Pc/Pm = P where PC is the price of South's exports, and Pm of its imports.

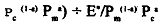

2) The Single Factorial Terms of Trade (SFTT) = P.Oc where Oc is output per person in the South. SFTT is the net barter terms of trade adjusted for the changes in productivity of exports. Then changes in SFTT measures the change in living standard of an exporter in terms of imports. Suppose productivity increases but price falls and the sum of the changes is zero, i.e., , then the SFTT index will be unchanged, namely, the living standard in terms of imports afforded by the exports is unchanged. But to the extent that the exported good is consumed at home, there is redistribution from producers to consumers. This gain is ignored by the definition of the SFTT. But this omission can be corrected. The Consumer Price index, CPI can be written as Pc1-apma where a is share of imports in the consumption basket. If E is money expenditure, then EICPI is real expenditure when trade is balanced. So real expenditure is:

, then the SFTT index will be unchanged, namely, the living standard in terms of imports afforded by the exports is unchanged. But to the extent that the exported good is consumed at home, there is redistribution from producers to consumers. This gain is ignored by the definition of the SFTT. But this omission can be corrected. The Consumer Price index, CPI can be written as Pc1-apma where a is share of imports in the consumption basket. If E is money expenditure, then EICPI is real expenditure when trade is balanced. So real expenditure is:

So the real expenditure has increased as P has decreased. But if employment is constant, there is a one to one relation between an output index and a productivity index, and the index for real expenditure per employed person, Pa.Qc, is the WSFTT or the weighted Single Factorial Terms of Trade.

DFTT Double Factorial Terms of Trade is adjusted for both the productivity of exports and productivity of imports. If the analyst is interested in the relative change in living standards, then the Double Factorial Terns of Trade (DFTT) is calculated.  where 0, is output per person in the North. This gives the relative value of the output of workers and combines relative prices and relative productivity.

where 0, is output per person in the North. This gives the relative value of the output of workers and combines relative prices and relative productivity.

Change in relative li'ving standards can be decomposed into employment, productivity and TT changes. Suppose we keep employment out of the picture then the remaining two factors of productivity and TT can be combined into the DPTT. But the DFTT provides an accurate measure of changes in the relative size of consumption baskets only in special cases (i) fraction of income qent on tradeable goods should be the same in the two countries (ii) the relative price component is trendless.

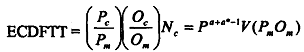

For the DFTT, relative real income of the South relative to the North is where E* is the expenditure in the North. When trade is balanced E = PEQE and E* = Pm Q*m, and this expression becomes (QeQm)P. Underlconstant employment assumption, this converts to k (QeQm)P where k is the constant ratio of persons employed in the two countries. k drops out when we view the last expression as an index. So

where E* is the expenditure in the North. When trade is balanced E = PEQE and E* = Pm Q*m, and this expression becomes (QeQm)P. Underlconstant employment assumption, this converts to k (QeQm)P where k is the constant ratio of persons employed in the two countries. k drops out when we view the last expression as an index. So

The trade unweighted version corresponds to the case where a+a* = 1. This condition is satisfied when the two countries have identical consumption patterns.

4)

Where NC is emplopent in the production of commodity, so that V is value of primary production.

The gives value of output measured in import prices. This is a useful measure as employment data to calculate Oc is often not available.

5) Employment Corrected IT Since there is full employment in the North, increased output in one sector does not increase total income as income in other sectors declines. But this is not so in the South where because of unemployment output foregone elsewhere is zero. To take account of this, we can calculate the employment corrected DFTT namely ECDFTT which equals

Where V = PcOcNc is index of output of exportables valued at current prices.

This extends the index to all three dimensions and also gets rid of troublesome OC, which can often not be calculated because of lack of data.

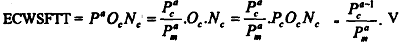

6) Employment corrected WSFlT is of interest to analysts again because of unemployment in the South.

The income where a = 1, terms of trade are POcNc, namely, they correspond to the case , and so equal P.X where X is quantity of exports, namely value of exports expressed in import prices.