The Arbitrage Pricing Theory:

The CAPM has the limitations that it is based on certain restrictive assumptions and that market factors are not the sole factor influencing stock returns Stephen Ross put forward the Arbitrage Pricing Theory (APT) in 1976 to address the shortcomings of the CAPM. It is a unique approach to determining asset prices. The CAPM assumes that investors decide within a mean-variance framework. The APT is a more general approach in that it assumes that asset prices can be influenced by factors other than mean and variances. APT makes certain assumptions that are the same as those made by CAPM. These are: investors have homogeneous beliefs; that investors are risk-averse utility maximisers; and that markets are perfect so that there are no transactions cost. However, unlike the CAPM, the APT does not assume a single-period investment horizon; it does not assume there are no taxes; it does not assume that investors can freely borrow and lend at the risk-free rate; and finally, it does not assume that investors select portfolio on the basis of mean and variance of a return.

APT makes an additional assumption which is not made under CAPM: it assumes that security returns are generated according to what is called a factor model. This means that there are underlying factors that give rise to returns on stocks. These may include the inflation rate, the rate of growth of GNP, or financial variables like capital structure and dividends. The theory assumes that the return on any stock is a linear function of these factors that are also called systematic factors or risk factors.

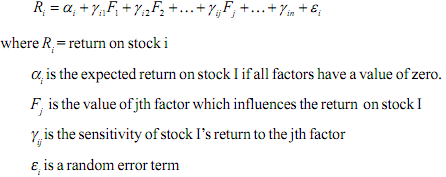

Ross employed an arbitrage argument to develop a model of equilibrium asset pricing. The arguments and mathematics are quite complex and advanced and beyond the scope of our discussion. We give the basic form of equations in the APT model. The equation depicts return on a stock as a linear function of the underlying factors:

Given the return-generating process in the above equation, the APT derives an equilibrium risk-return relationship. The key idea underlying this derivation is the law of one price, which says that an identical good cannot sell for different prices (there should be no arbitration). Applied to portfolios it means that two portfolios that have the same risk cannot differ in terms of expected returns. If it were so some people will take advantage of the situation and buy cheap and sell dear. Ain other words,

arbitrage would take place. Hence in equilibrium there should be no scope of arbitrage.

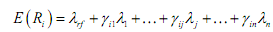

The equilibrium equation according to the APT is as follows:

where λrf is return on risk-free asset, λij is the risk premium for the type of risk associated with factor j E(R) expected return on stock i.