Stolper-Samuelson Theorem:

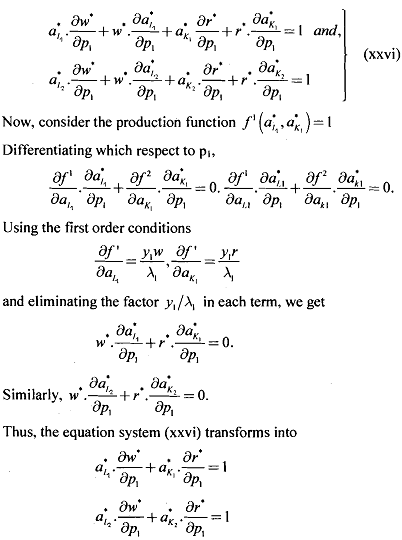

To determine the effects of changes in output prices on factor prices we differentiate the above two cautions with respect to prices. We have,

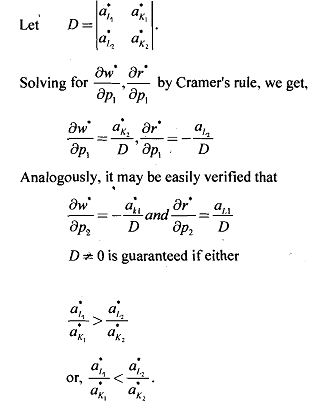

That is, if one industry is more labor intensive than the other, the above comparative - statics result is well defined.

For example, suppose industry-l is labor intensive, then

These results are known as the Stolper-Samuleson theorem. Essentially, the insight thrown by these is: if the price of labor-intensive industry is increased, nominal wage rate will rise whereas capital rental rates will fall. Generally speaking, the price of a factor of production will rise if the output price of the industry, in which that factor is most intensively used, rises; it will fall if the output price of the industry, which is less intensive in that factor, increases.

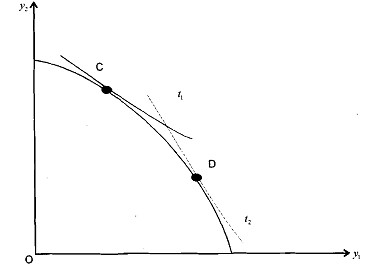

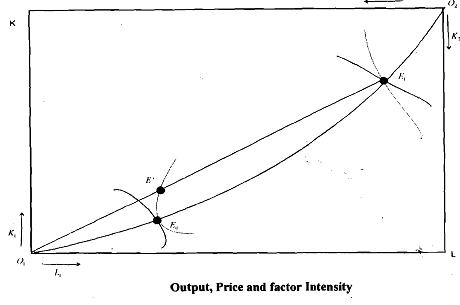

Let us now present this diagrammatically.

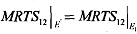

Consider an increase in P1/P2 such that the price line (t1) is steeper than (t2). In a full employment economy, efficient production point moves from C to D such that production of yl rises and y2 falls. Correspondingly, the economy moves from E0 to E1 along the contract curve O1 O2. Due to CRS, along any ray through the origin MRTS12 is the same. Thus, we have

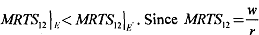

. Given diminishing MRTS, along on isoquant we 4 W have

. Given diminishing MRTS, along on isoquant we 4 W have is the optimum point, we get

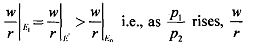

is the optimum point, we get

rises. Thus, producers in both sectors

substitute K for L. The increase in capital intensity implies MPL rises and MPk falls in both the sectors. Profit maximisation requires, MPL = real wage to rise and MPK = real rental to fall.