Expectations hypothesis:

The expectations hypothesis asserts that longer-term interest rates are an average of the shorter-term interest rates expected to prevail over the life of the long-term asset. To make this assertion the theory assumes that investors perceive a series of short-term bonds as perfect substitutes for long-term bonds. Since investors consider short and long-term bonds as substitutes (in terms of quality) the only factor affecting the investor's decision is the expected return to be earned from purchasing a larger number of short-term bonds as compared to a single long-term one. The expectations hypothesis also assumes implicitly that investors are risk neutral and are not willing to pay a premium to lock-in a higher duration interest rate. It also assumes that there are no transactions costs either, so that the cost of buying a short-term asset is the same as buying a long-term asset.

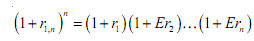

The expectations theory says that the investor should expect to receive the same return from either investing in a n-period long-term bond, say, or the same amount in a i-year bond over a period of n years, that is, n times. Mathematically, it can be depicted as

where shows yield to maturity for a bond beginning in the current time period and maturing in period n. The left-hand-side of the above equation shows the future value of rupee one invested in an n-year bond, while the right-hand side represents the future value of rupee one invested in a series of 1-year bonds over a period of n years. Of course, the future one-period interest rates Er2 , Er3 , ...Ern would be expected rates from the point of current time period.