Analyzing the Current Business Portfolio

In order to analyze the present business portfolio, the company have to conduct portfolio analysis (a tool by which management recognizes and evaluates the several businesses that make up the company). Two steps are significant in this analysis:

1). the first step is to recognise the key businesses (SBUs). The strategic business unit (SBU) is a company unit that has a separate and objectives and mission, which can be planned separately from other company businesses.

2). The SBU may be a company division, product line within a division, or even just a single product or brand.

3). the second step is to assess the magnetism of its many SBUs and decide how much support each deserves. The best-known portfolio planning scheme is the Boston Consulting Group (BCG) matrix:

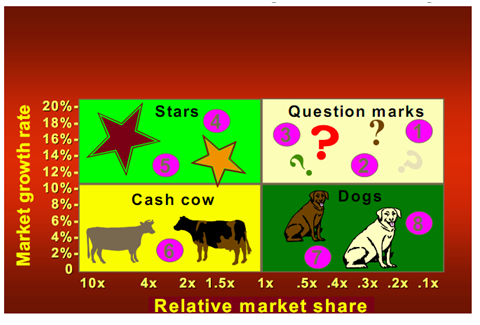

1). by using the BCG approach, where a company classify all its SBUs according to growth-share matrix.

a). The vertical axis, market growth rate, gives a measure of market attractiveness.

b). the horizontal axis, relative market share, serves like a measure of company strength in market.

2).By using the matrix, four types of SBUs can be recognized:

- Stars

- Cash Cows

- Question Marks

- Dogs

a). Stars are high-growth, or high-share businesses or products (they need heavy investment to finance their speedy growth potential).

b). Cash Cows are low-growth, or high-share businesses or products (they are established, victorious, and require less investment to hold share).

c). Question Marks are low-share business units in high-growth markets (they need a lot of cash to hold their share).

d). Dogs are low-growth, low-share businesses and products (they can generate sufficient cash to maintain themselves, but do not have much future). Once it has classified its SBUs, a company have to determine what role each will play in future. The four strategies that can be pursued for each SBU are following:

1). the company can invest more in business unit so as to build its share.

2). the company may invest adequate just to hold at the current level.

3). the company may harvest the SBU.

4). the company may divest the SBU.

As time passes, SBUs change their positions in growth-share matrix. All has its own life cycle. The growth-share matrix has done much to support strategic planning study; although, there are problems and limitations with the method.

1). they can be hard, time-consuming, and expensive to implement.

2). Management may find it hard to define SBUs and measure market growth and share.

3). they focus on classifying current businesses but provide little recommendation for future planning.

4). they can lead company to placing too much emphasis on the market-share growth or growth through entry into gorgeous new markets. This may cause unwise expansion into hot, new, risky ventures or giving up on the established units too rapidly. In spite of the drawbacks, most of the firms are still committed to strategic planning.