Optimal Provision of Public Goods:

The problem now is to determine how much of public good or bad should be provided. The standard approach in the case of private goods is to use price mechanism to allocate resources efficiently between different goods. For public goods, however, we have seen that non-excludability invalidates the use of price mechanism for resource allocation. Samuelson Rule for the Provision of Public Good Consider an economy with two persons and two goods; one public good and the other private good. The amount of the public good is denoted by x, and the amount of the private good consumed by individual i be denoted by eel, i = 1, 2. Note that because the level of consumption of the public good must be the same for each consumer, the argument x does not have i subscript. The technological possibilities of the economy are described by a transformation function T(x, y, +y2). The function T(.,.) tells us how much of the private good is required to produce one unit of the public good.

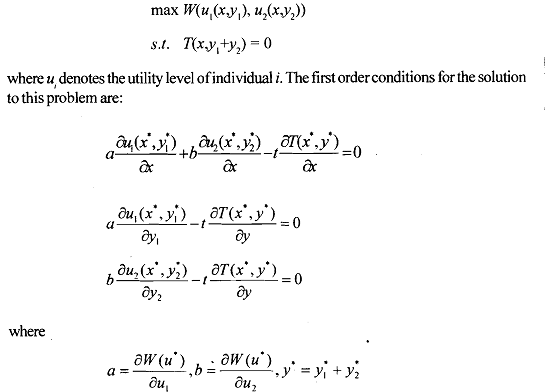

The welfare function for the economy is defined over the utilities of both individuals. The welfare maximization problem can be written as:

where ul denotes the utility level of individual i. The first order conditions for the solution to this problem are:

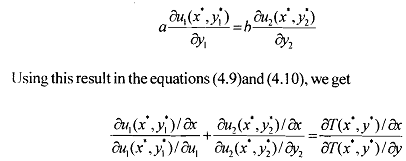

'The above is a classic optimality condition for a public good first derived by Samauelson (1954). According to the Samuelson rule, the social value of a good is equivalent to the combined willingness to pay of all the consumers of that good. Note that the conditions for optimality for a public good differ from the conditions characterizing a competitive market solution. At the optimal level of the public good, instead of MRS=MRT for each consumer, we require sum of marginal rates of substitution between public and private goods across all consumers be set equal to the marginal rate of transformation. The MRS, can be interpreted as individualized prices -how much consumer i is willing to sacrifice of the private good to pay for one more unit of the public good. This can be thought of as how much consumer i should be taxed. Under this interpretation we see the basic "duality" between public and private goods: in the private-goods case, we all consume different amounts of the good but pay the same price; in the public good case, we all consume the same amount of good but have different prices.

Samuelson condition for optimal provision of a public good: The marginal rule of transformation of a public good-for a private good should be equal to the sum over all individuals of their individual marginal rates of substitution of the public good-for the private good.