Non-optimality of the Competitive Outcome:

The question arises why should we be worried about externalities? The basic problem is that the generator of the externality is deciding how much of the externality to produce but is not taking into account the effects of the externality on others. Let us model

such interactions in a simple way. Suppose we have two producing units, a steel mill and a fishery along a river, steel mill being upstream. The steel mill produces x units of steel from labor according to a production function where I, denotes amount of labor employed in steel mill. In contrast wi th the standard competitive model, however, we assume that each unit of steel production unavoidably produces some waste or pollution, which is dumped into the river. Let h(x), h'(.)>O, represent this pollution (pollution is monotonically increasing in steel production). The fishery produces y units of fish depending on the amount of labor it employs and the amount of pollution in the water

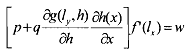

We assume f(.) and g(.,.) to be concave production functions and [/]<0. As the steel firm's production ofh(.) affects the fishery's output, it generates an externality. Let p, q, and w denote the prices of steel, fish and labor, respectively. We assume perfect competition in factor and product markets so that the actions of either the steel mill or the fishery do not affect these prices. The profit functions of the two firms are given by

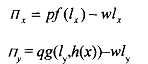

Each of the two firms chooses output and thus the amount of labor employed to maximize its profit. Assuming interior solutions, the necessary and sufficient first order profit maximizing conditions are

for the fishery. These equations imply that the two firms will employ labor until the value of marginal product of labor in their respective units is equal to the wage rate. The output chosen by the two units may not be socially efficient as the output of the steel mill adversely affects the output of fish but the effect is being ignored by the steel producer. We will see below that she is producing "too much" steel. What would a socially efficient production plan look like?

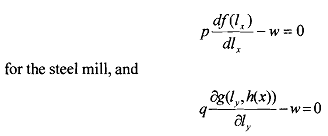

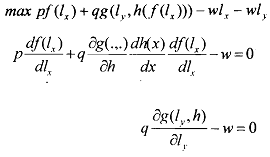

In any Pareto optimal allocation, the optimal level of h must maximize thejoinl surplus of the two firms. Let us, therefore, consider what would happen if one tirm owned both the steel mill and the fishery, and maximized aggregate profits: