Determination of optimal allocation:

The determination of the optimal allocation of a private and apublic good is illustrated geometrically in Fig. while that for a public good is given at Fig. The horizontal axis shows the quantity and the vertical axis shows price, marginal rate of substitution and marginal rate of transformation. Individual marginal rates of substitution are represented by MRS, i = 1.2. curves. In Fig, the curve to the extreme right, MRSH represents aggregate marginal rate of substitution and is obtained by summing individual MRS, curves horizontally. For any given price, we see the total amount of the good the consumers wish to consume. The condition for Pareto efficiency in the case of private goods is that each agent is consuming at a level ,where her MRS, equals the price ratio.

which in turn is equal to the MRT. In order to determine price, we find the point of intersection of AIRSH curve and the MRT curve. Once we know the price, p: we can find the consumption levels ofeach agent by looking at the consumption levels that equate MRS, with pi for each i. In Fig. y = y1 + y2 is the total output of the private good, y: being the amount consumed by consumer i.

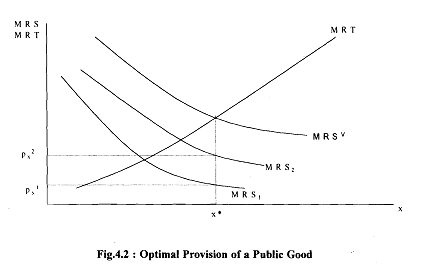

In the case of a public good, we proceed differently . We are interested in the total marginal willingness to pay for specific amounts of the public good. The difference here is that both consumers consume the same amount of the good. The condition for Pareto efficiency in this case is that the level of consumption of the public good is where the sum of the individual marginal rate of substitution for both consumers equals the MRT, i.e., the total willingness to pay equals the social cost.

To capture this, we sum individual MRS, curves vertically. The aggregate curve is shown as MRSV The point of intersection of the MRT curve and the MRSV gives us the optimal level of output of the public good. We can find each agent's willingness to pay at that level of output by inspecting the individual MRS curves. We could use this information to tax the individual consumers in order to pay for the public good.

Then each agent would be paying exactly his or her true valuation of the public good. This kind of taxation scheme - called a Lindahl equilibrium - seems to be an especially fair way of paying for the public good. In Fig, pi. i = 1,2 represent these individualized prices. This kind of pricing scheme could be rather difficult to implement.