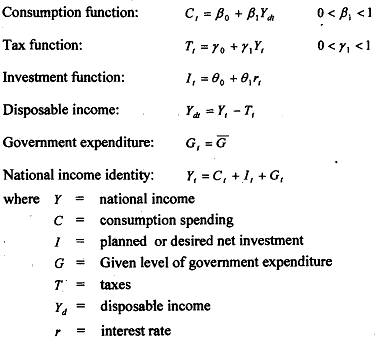

Macroeconomic Model:

The celebrated IS model, or goods market equilibrium model of macroeconomics in its non-stochastic form can be expressed as

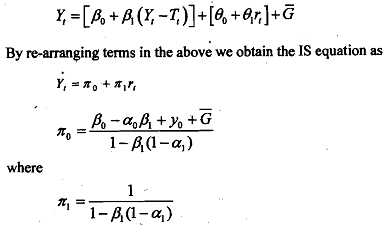

In order to solve the above equation system. Consequently we obtain

Equation is the equation of the IS cuze, or goods market equilibrium, which provides the combinations of the interest rate and level of income such that the goods market is in equilibrium.

What would happen if we were to estimate, say, the consumption function in isolation? Could we obtain unbiased and/or consistent estimates of β0 and β1? Such a result is unlikely because consumption depends on disposable income, which depends on national income Y; but the latter depends on r and G as well as the other parameters entering in Π. Therefore, unless we take into account all these influences, a simple regression of C on YA is bound to give biased and/or

inconsistent estimates of β0 and β1.