Keynesian model of Income Determination:

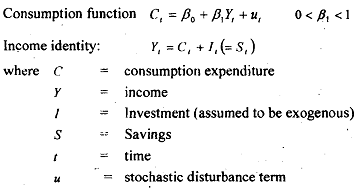

Consider the simple Keynesian model of income determination:

The parameter β1 represents the marginal propensity to consume (MPC). From macroeconomic theory we know that β1 is expected to remuin between 0 and 1. Equation is the consumption function which shows that consumption depends on autonomous consumption expenditure β0 and income induced consumption β1Y . Equation is the national income identity, signifying that total income is equal to total consumption expenditure plus total investment expenditure.

From the consumption function it is clear that C and Y interdependent and that Y1 is not expected to be independent of the disturwce term, u1 . When u, changes (because of a variety of factors subsumed iwe error term) the consumption function also shifts, which, in turn, affects y1 Therefore, once again the classical least-squares method is not applicable. If applied, the estimators thus obtained will be inconsistent.