Modified Duration:

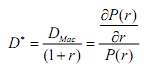

While all of this is useful, it does not tell investors exactly how much a bond's price changes given a change in yield. However, it was noticed that there is a relationship between Macaulay duration and the first derivative of the price/yield function. This relationship led to the definition of modified duration:

where

• D* is the modified duration;

• DMac is the Macaulay duration;

• r is the periodic yield;

• P(r) is the price of the bond at yield r.

This measure expands or modifies Macaulay duration to measure the responsiveness of a bond's price to interest rate changes. It is defined as the percentage change in price for a 100 basis point change in interest rates. The formula assumes that the cash flows of the bond do not change as interest rates change, which is not the case for most callable bonds.