3) Effective Duration: Effective duration (sometimes called option-adjusted duration) further refines the modified duration calculation. Effective duration requires the use of a model for pricing bonds that adjusts the price of the bond to reflect changes in the value of the bond's "embedded options" (e.g., call options or a sinking fund schedule) based on the probability that the option will be exercised. All things being equal, as interest rates fall, bonds with embedded call options are exercised and the "in-the-money" bond is repaid. If interest rates rise, embedded options will not be exercised and the "out-of-the-money" bond will continue to maturity. Effective duration will shorten and be closer to the call date for "in-the-money" bonds, while lengthening and being closer to the maturity date for "out-of-the-money" bonds.

Three factors that influence the duration calculation are coupon rate (which determines the size of the periodic cash-flow), interest rates (which determines the present value of the periodic cash flow), and maturity (which weights each cash flow) all contribute to the above duration measures. As a result, the two main principals of duration are:

As maturity increases, duration increases and the bond's price becomes more sensitive to interest rate changes.

- A decrease in maturity decreases duration and renders the bond less sensitive to changes in market yield. Therefore, duration varies directly with maturity. As the bond coupon increases, its duration decreases and the bond's price becomes less sensitive to interest rate changes.

- Increases in coupon rates raise the present value of each periodic cash flow and therefore the market price.

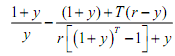

This higher market price lowers the duration. Let us now mention some properties of duration. First, the duration of a zero-coupon bond is the same as its maturity. Second, for a given maturity, a bond's duration is higher when its coupon rate is lower. Third, for a given coupon rate, a bond's duration generally increases with maturity. Fourth, other things remaining the same, the duration of a coupon bond varies inversely with its yield to maturity. Finally, the duration of a coupon bond is approximately

where y is the bond's yield per time period, T is the number of payment periods, and r is the coupon rate per payment period.