Operation of Insurance- State Contingent Commodities:

We have seen above that risk preference generates demand for insurance. Let us now extend that discussion by taking insurance as a 'state contingent commodity'. That is, a good, which you buy now but only consume if a specific state of the world arises. For example, when you buy insurance you are buying a claim on Re. 1.00. Such insurance is purchased before the state of the world is known. You can only make the claim for the payout if the relevant state arises.

While analyzing consumer behaviour, we've drawn indifference maps across goods X,Y. Now we will draw indifference map across states of the world: good, bad.

Consumers can use their endowment (equivalent to budget set) to shift wealth across states of the world via insurance, just like budget set can be used to shift consumption across goods, X, Y.

Example

Two states of world, good and bad. Wealth in these two states and probability of occurrence of the states are given as, wg = 120

wb = 40

Pr(g) = P = 0.75 and Pr(b) = (1 - P) = 0.25.

Then, E(w) = 0.75(120) + .25(40) = 100 and E(u(w)) < u(E(w)) if agent is risk averse.

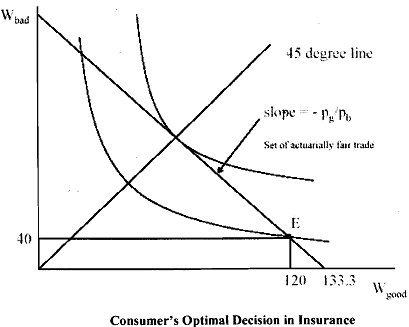

Let us look at Figure 20.5 to assess the consumer' optimal decision.

Let's say that this agent can buy actuarially fair insurance. If you want Re.l.OO in Good state, this will sell of Rs.0.75 prior to the state being revealed.

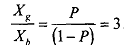

If you want Re.l .OO in Bad state, this will sell for Rs.0.25 prior to the state being revealed. As you can observe the price set is such that these are the expected probabilities of making the claim. So, a risk neutral agent (say LIC of India) could sell you insurance against bad states at a price of Rs.0.25 and insurance against good states (assuming you wanted to buy it) at a price of Rs.0.75. The price ratio is therefore

The set of fair trades among these states can be viewed as a budget set and the slope is  . Now we bring in indifference curves. Recall that the utility of this lottery (the endowment) is:

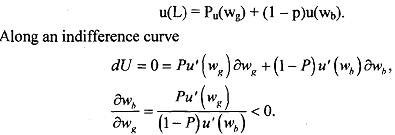

. Now we bring in indifference curves. Recall that the utility of this lottery (the endowment) is:

Provided that u() concave, these indifference curves are bowed towards the origin in probability space. We can then prove that indifference curves are convex to origin by taking second derivatives. But intuition is straightforward.

Flat indifference curves would indicate risk neutrality - because for risk neutral agents, expected utility is linear in expected wealth.

Convex indifference curves means that you must be compensated to bear risk. Thus, if I gave you Rs.133.33 in good state and 0 in bad state, you are strictly worse off than getting Rs. 100 in each state, even though your expected wealth is

E(w) = 0.75 . 133.33 + 0.25 . 0 = 100

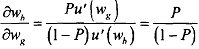

So, I would need to give you more than Rs.133.33 in the good state to compensate for this risk. It is easy to see that there are potential utility improvements from reducing risk. In the figure, u, + u, is the gain from shedding risk. Also notice from Figure 20.5 that along the 45' line, w, = wb. But if w, = wb, this implies that

Hence, the indifference curve will be tangent to the budget set at exactly the point where wealth is equated across states. This is a very strong restriction that is imposed by the expectedutility property: The slope of the indifference curves in expected utility space must be tangent to the odds ratio.