Transformation of variables:

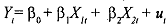

Consider the earlier example of consumption expenditure, income and wealth. Here the data is of the time series format, that is, we have data on the same variables for a number of years or months. One reason for high multicollinearity is that over time both income and wealth tend to move together in the data. One way of minimizing this dependence between the variables is to take thejrst difference of the variables. If the relation is

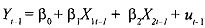

which holds at time t, then it must also hold at time t-1. Therefore, we have

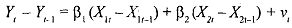

Subtracting equation

where vt = ut - u. In other words, instead of running the regression on the values of the variables we run them on the difference between the successive values of the varinbles. This reduces the problems associated with multicolliriearity since although X1 and X, might be highly correlated there is no reason to believe that the changes in their levels over time are also highly correlated.

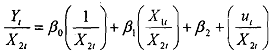

Another transformation that is commonly used is the ratio transformation. Again consider the earlier model from equation (6.18) above. Let Y be consumption expenditure in real dollars, X, be GDP and X, be population. Since both GDP and population grow over time they are likely to be correlated. One 'solution' is to express the model in per capita terms, that is, dividing throughout by X, we get

Such a transformation'mayreduce collinearity in the original variables. However, note that the remedy might be worse than the disease. Since it is knom that the error term in equation will suffer from problems of heteroscedasticity even when the original errors in are homoscedastic. Similarly, it is also known that the error term obtained in the first difference method v, in equation is going to be serially correlated even when the original error terms u, were serially uncorrelated.