Pooling of data:

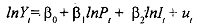

Another variation of using the apriori information method outlined above is to combine cross-sectional and time-series data, also known as pooling the data. Consider the following example - say you are interested in studying the demand-for automobiles in India. Assume you have time series data on the number of cars sold, average price of the car and consumer income. The model specified is as follows:

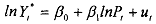

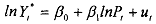

where Y =number of cars sold, P =average price, and I = income and the subscript t is the time period. Our objective is to estimate the price elasticity Pi and the income elasticity β, . In time series data the price and income variables generally tend to be highly collinear. Therefore, if we run the regression given at, we shall be faced with the usual multicollinearity problem. A way out of this has been suggested by Tobin. He says that if we have cross-sectional data (for example, data generated by consumer panels, or budget studies conducted by various private and governmental agencies), we can obtain a fairly reliable estimate of the income elasticity β2 because in such data, which are at a point of time, the prices do not vary much. Let the cross-sectionally estimated income elasticity be β2. Using this estimate we can rewrite the preceding time series regression as,

where , that is, Y represents the value of Y after removing from it the effect of income. We can now obtain an estimate of the price elasticity from the preceding regression.

, that is, Y represents the value of Y after removing from it the effect of income. We can now obtain an estimate of the price elasticity from the preceding regression.

This creates a problem of interpretation of the data, because we are assuming that the cross-sectionally estimated income elasticity is the same as that which would be obtained from the time series data. Nevertheless this technique has been used in numerous studies.