Risk Transfer:

Consider a logarithmic utility function which exhibits declining absolute risk aversion. So more wealthier you are, the lower is your cost of bearing a fixed monetary amount of risk. When utility cost of risk is declining in wealth, less wealthy people could pay more wealthy people to bear the risk. Consequently, both parties would be better off.

Example

The utility function is represented as u(w) = ln(w). Let an individual face a 50 percent chance of losing Rs.100. The willingness of this person to pay for eliminating this risk depends on her initial wealth.

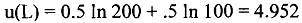

If we assume the initial wealth is Rs.200, the expected utility can be obtained as

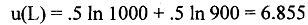

The certainty equivalent of this lottery is exp(4.59) = 141.5. Therefore, the individual would be willing to pay Rs.8.50 to defray this risk. Let there be an individual with initial wealth of Rs. 1,000. We assume that the utility function is same with that of the above case. Then the expected utility

The certainty equivalent of this lottery is exp(6.855) = 948.6. Hence, this agent would be willing to pay only Rs.1.4 to defray the risk. See that the wealthy rnemb-r could fully insure !he poor member at a cost of Rs. 1.4 while the poor member would be willing to pay Rs.8.5 for this insurance. Therefore, they may agree for a price between Rs.1.4 and Rs. 8.5. Such an outcome will be Pareto improvement.