Optimising solution:

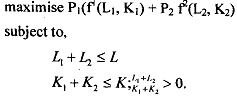

If we consider the problem set up above, then we can write the reduced model as follows:

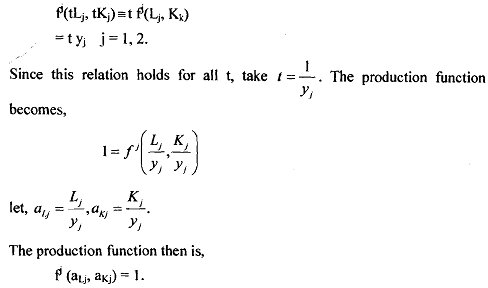

Here, L and K are, respectively, the parametrically 'fixed' total resource endowment of labor and capital. Now, we will make another simplifLing assumption, namely, f2(LI, KI), and P(L2, K2) exhibit constant returns to scale (CRS) i.e.,

We can use the above optimisation programme to derive major theorems of international trade as well. We assume that L1, L2, K1 and K2 are fully used up at parametrically given levels of L and K, respectively.

The Lagrangian for this model is

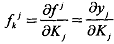

The first-order conditions for constrained maximum are obtained by differentiating with respect to the four choice variables L1, L2, KI, K2 and the two Lagrange multipliers. We get

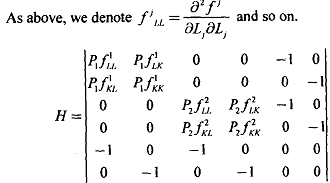

The second order conditions consist of restrictions on border-preserving principal minors of the border Hessian determinant formed by differentiating equations (i) to (vi) again with respect to the L,'s , L, 's and λ, 's .

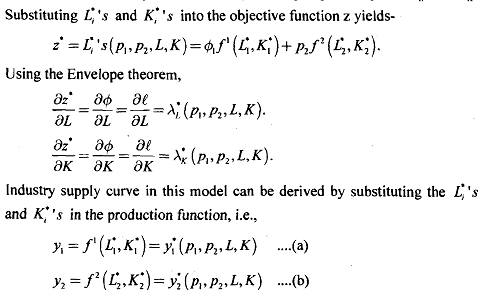

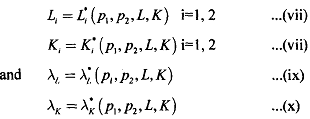

The border-preserving principal minors of K alternate in sign, the whole determinant having sign +l. Assuming the sufficient second-order conditions hold, first order conditions can be solved for the explicit choice functions.

In the above, (vii) and (viii) show the quantities of each factor that will be used by each industry at given output prices and total resource constraints.

The role of the factor prices is filled by the Lagrange multipliers λL, and λK,