Financial Crunch

Power is a critical infrastructure for economic growth. The economic acceleration would hugely depend upon a commercially viable power sector. The reality is n which most of the power utilities, particularly the State Electricity Boards, are in a financial mess today. Their losses have gone up more than 5 times in the last decade. A vast majority of states display a negative rate of return. The average revenue per unit does not cover even the cost of supply. There is a gap of about 80 paisa per unit.

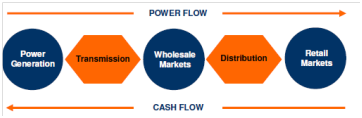

Figure: The Electricity Value Chain

The reasons for the poor financial health of distribution utilities are many and listed in Table 2.

All the factors described above have added to the financial burden of the distribution utilities along with ominous effect on their financial health. Commercial viability of the distribution sector is the key to growth and development of the sector, because of this is the source of flow of money within the system. The financial resources so generated could be used to fund main infrastructure improvements and upgrading the distribution system. Therefore, restoring the financial health of the distribution utility is a main challenge today.

|

Sl. No.

|

Reasons for Poor Financial Health

|

Does it apply to your utility?

|

|

1.

2.

3.

4.

5.

6.

7.

8.

|

High T&D losses

Lack of commercial approach

Free or highly subsidized agricultural supply

Low frequency of tariff revision

Poor metering

Subsidized domestic consumption in most of the cases

Low revenue realization rate

Rampant theft in collusion with unscrupulous elements

|