Failure of the Pooling Equilibrium:

Although in Figure, A satisfies one of the equilibrium conditions, i.e., the breaks even condition by virtue of its being on the aggregate fair odds line, it fails in case of another. See that no potentially competing contract can make a non-negative profit. For example, if another insurance company offers a policy like point B in the figure, types H will not be the gainers. As B lies strictly below UH, SO H types are happier with the current policy.

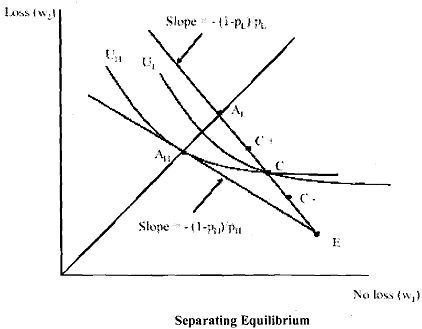

However, consider L types. They strictly prefer this policy as B is above UL. Since B lies above the fair odds line for the pooling policy it offers a better deal to this group. However, it fails to provide much insurance as it lies closer to E than that of A. T subsidising the H types. It is clear that for the opposite reasons, H types would prefer the old policy. So, when policy B is offered, all L types change to B, and the H types stick with A. Because B lies below the fairs odds line for L types it is profitable if it attracts L types. But A cannot be offered without the L types participating as it requires the cross-subsidy.

Consequently, the pooling equilibrium cannot exist. It is always undermined by a 'separating' policy that skims off the L types from the pool. See that the insurer enters into a process whereby it tries to select the most favourable individuals with expected losses below the premium charged. Free entry leads to 'cream skimming' of low-risk from the pool and makes it difficult or impossible for individuals with high expected losses to purchase private insurance. This causes pooling policy to lose money because only high risk remains and pooling policy disappears.

In above result we see how it makes sense to separate the profitable group from that of the less profitable one. If an insurance company loses money on one group but makes it back on another, there is a strong incentive to separate the profitable from the unprofitable group and charge them different prices or just drop the unprofitable group, thereby undermining the cross-subsidy.