Employees Stock Ownership Plans

Employee stock ownership strategy originated in the USA in early 90s. Under employee stock option strategy, the qualified employees are allotted company's shares below the market price. The term stock option refers the right of an eligible worker to purchase a definite amount of stock in future at an agreed cost. The eligibility criteria might include contribution to the department/division where the worker works, length of service etc. The company might even let employees to pay the cost of the stock allotted to them in instalments or even advance money to be recovered from their salary of every month. Generally the allotted shares are held in trust and transferred to the name of the worker when he or she decides to exercise the option. The stock options empower the employee to participate in the development of the company as a part owner. It also helps the company to hold talented employees and make them more committed toward the job.

Employee stock options are welcomed everywhere due to their in-built interesting potential. Some powerful benefits offered by Esops might be catalogued thus:

- Stock options are a marvellous motivator because they link directly performance to the market place. The underlying rationale is to allow employees add value to a company and benefit from it on the similar terms as any other provider of risk- capital.

- Employees remain loyal & committed to the company. To become part owners, everybody ought to stay for a while, contribute their best and then share the resultant benefits according to an agreed criteria. Stock options inspire people to give their greatest to the company because particular performances will translate into share price enhanced only if it is part of a larger collective effort.

- By transforming your worker into a stockholder, stock options foster a long-term bond among the employee & the company. Employees start to look at themselves as actual owners in place of only paid servants of a company. ESOPs give workers a 'piece of the action' so that they may share in the development and profitability of their company. Everyone also loves the concept of worker ownership as a kind of "People's capitalism."

- ESOPs underscore the significance of team effort among employees.

- Better industrial relations, decrease employee turnover, increased dividend income, lesser supervision, etc., are other incidental benefits.

ESOPs have their critics as well who attack the process on the following grounds:

- Only profitable companies may use the tool

- Stock prices do not reflect fundamentals always

- Falling share price could mean losses for workers

- The inability to cash in rapidly can dampen interest

- Lack of transparency may earn accusations of favouritism

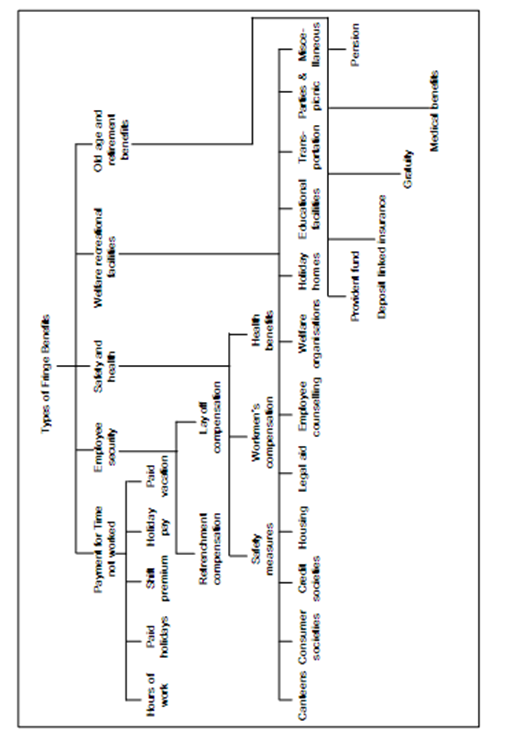

Figure 1: Type of Fringe Benefits

Employees' sharing the platform along owners, evidently, may be a disadvantage because they might feel 'forced' to join, therefore placing their financial future at large risk (for example., workers who opted for ESOPs during the software boom in the late 90s have suffered very much losses while stock prices crashed subsequently). Another drawback is that ESOps could be utilized by managements to fend off unfriendly takeover efforts. Holders of stock options frequently align with management to turn down bids that would advantage outside shareholders but would replace management & restructure operations. Certainly, ESOPs are not meant to entrench ineffective management. In spite of these disadvantages, ESOPs have developed in popularity in recent times.