Edgeworth Model:

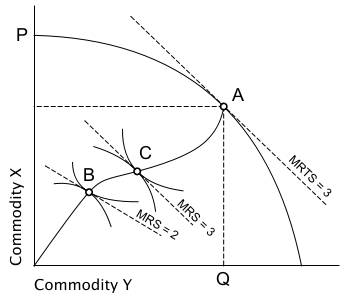

To analyse the Edgeworth solution of oligopoly let us consider two profit maximising firms A and B, selling a homogeneous product and having identical cost function with marginal cost (MC) equals to zero. We also assume that they face a linear market demand curve. In the following figure, DA represents the market demand faced by firm A and DB represents that of firm B.

Unlike Bertrand, Edgeworth assumes that none of the duopolists can produce an output as large as the competitive market's.

Suppose firm A is the first one to enter the market. Equating MR and MC, it decides to produce OE at price OP1.Now suppose B enters the market and sets price slightly below OP1 and thus captures all of A's customers. But then B can cater to the market demand only up to OD, hence amount left to be sold by firm A is AC (= DB, by construction). Firm A rather than accept the reduction in revenue decides to reduce the price slightly below that of B's. As a result, A can now capture all of B's customers. However, once again, A can sell only up to OC. This process would go on until price falls to OP2, and each of the duopolist produce the maximum possible output.

However, the price OP2 is not stable because one of the firms can raise it's price and thereby it's revenue as well as profit (because MC = 0). For instance, A will try to raise price assuming B will maintain it if OP2. A has no fears of loosing customers to B, because B is producing it's maximum possible output so that rest of the market is to be catered to by A only. Now B would also reconsider that a price rise from OP2 would not result in a loss of sales. Therefore, it would raise price almost up to OP1. A would respond by reducing price and the same process ensues once again as before. We see that price would fluctuate between OP1 and OP2 and there would be no stable price equilibrium.