Chamberlin's Oligopoly Model:

Chamberlin suggested that a stable equilibrium can be reached in an oligopolistic market if the firms charge monopoly price. This will be possible if the firms recognise their interdependence, unlike in the Cournot model where they act on the naïve assumption of rival marinating its previous period's price or output level.

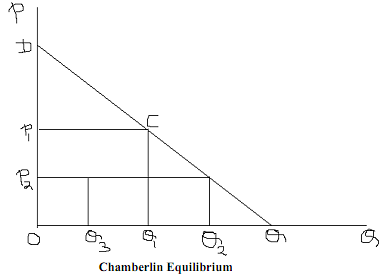

In this model, the setting (i.e., assumption) is similar as that in Cournot's except for the fact that the firms do recognise their mutual interdependence. Let us study the model on the basis of the following diagram. Let DQ be the linear market demand curve. Suppose firm A enters first in the market and sells OQ1 units at the price OP1 on the basis of (MR = MC), thereby reaping monopoly profit given by the area OQ1CP1.

Let us now consider firm B's entry into the market. Given that firm A produces OQ1, CQ becomes firm B's relevant market demand curve. Therefore, the best B can do acting on the basis of (MR = MC) is to market Q1Q2. As a result, price falls to OP2 and the total profit accruing to both is given by the area OQ FP .

According to Chamberlin, firm A will survey the market situation after B's entry and will figure out that sharing the profit level OQ1CP1 is the best for either of them. Therefore, firm A would reduce it's output level from OQ1 to OQ3 and firm B would stick to the output level Q1Q2 = Q3Q1. With this arrangement, the firms together produce OQ1 and the price level is retained at OP1. Thus, we see that firm A produces OQ3 = ½ OQ1 and B Q3Q1 = ½ OQ1.

The total output is OQ1 to be sold at a price OP1 with firms A and B sharing the monopoly profit equally. Firms, in this kind of an agreement, produce more than in the Cournot case, where each one produces one-third of the total market demand.