Speculative Demand for Money:

Speculative Demand for Money: The speculative demand for money is the demand for money as an asset or as a store of value. Through it Keynes made (a part of) the demand for money a declining function of rate of interest. The speculative demand for money constitutes the main pillar of Keynes' revolution in monetary theory and Keynes' attack on classical QTM.

The speculative demand for money arises from the variability of interest rates in the market and uncertainty about them. For simplicity, Keynes assumed that all securities (bonds, debentures, shares etc.) to be of only one type, i.e. perpetual bonds. These perpetual bonds are the only non-money financial assets, which compete with money in the asset portfolio of the public. Money doesn't earn its holders any interest income but its capital value in terms of itself is fixed. Bonds on the other hand, yield interest income to their holders. But this income can be more than wiped out if bond prices fall in future.

Economic agents hold a part of their wealth in the form of financial assets. In the two assets model of money and bonds (perpetual), bond prices keep changing sometime with the change in the rate of interest. Therefore, they are subject to capital gains or losses. Thus, to be a bondholder the return from bond holding per unit period (say a year) per rupee is the rate of interest ± capital gains or loss per year. At the time of making decision about investment in bonds, the market rate of interest will be a given datum to an economic agent, but the future rate of interest gain or loss will have to be anticipated. Hence the element of speculation in the bond as well as the money market comes in.

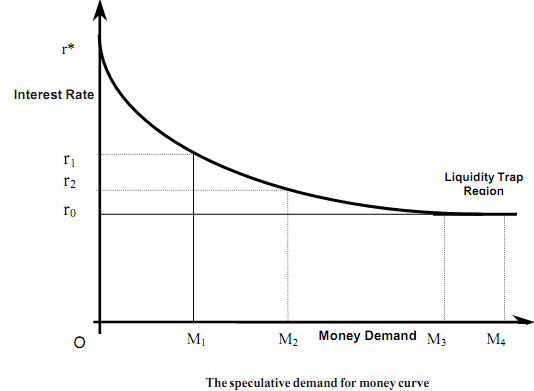

In Keynes' theory, an economic agent holds either money or bonds but not both at any given rate of interest. The speculators are of two types - bulls and bears. Bulls are those who expect the bond prices to rise in future. Bears expect these prices to fall. Bulls are assumed to invest all their idle cash into bonds. Bears instead will move out of bonds into cash if their expected capital losses on bonds exceed interest income from bond holding. Thereby they minimise the losses. Thus, the speculative demand for money arises only from bears. These bears accumulate their cash balances to move into bonds when bond prices will rise in future. Thus, at a very low price of bonds, all may be bulls (which mean that 'r' will be quite high). At this point (r*), the speculative demand for money will be equal to zero. But at a lower rate of interest (r1 ) (higher bond prices) some bull will become bears and a positive speculative demand for money will emerge (M1). At a still lower rate of interest (r2 ) (still higher bond prices) more bulls will become bears and there will be even higher speculative demand for money (M2 ). This is how Keynes' derives his famous downward sloping aggregate speculative demand for money schedule with respect to rate of interest, as shown in figure. In the extreme, the interest rate could fall so low that no one expects it to fall further. In this case, the demand for the Msp becomes infinitely elastic. A good example of this phenomenon has been the Japanese economy since the mid nineties where the interest rate has been close to zero.