Money supply process:

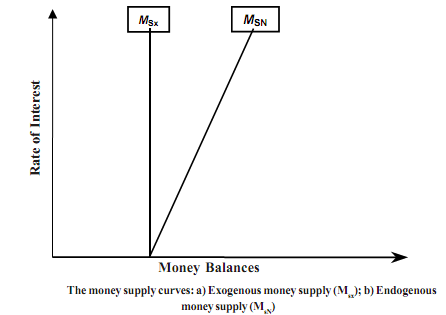

The supply of money (Ms) could be assumed to be exogenous or endogenous. In the exogenous money case, the money supply is determined outside the system. In other words, monetary authority determines the supply of money and banking (or financial) sector, firms and households do not play any role in influencing it.

Ms = M (given, exogenously) Where Ms = supply of money.

However, in the case of endogenous money the banking sector along with firms and households play an important role in influencing the money supply. If money supply is assumed to exogenous then it is given and is not a function of rate of interest. In the classical model money is considered to be exogenous in the sense the monetary authority has complete control over it. This means it is not affected by the changes in the interest rate. In case of endogenous money, the monetary authority has no control over the money supply, and the demand for money determines the supply of money. This happens through the money multiplier process.The process works as follows: whenever central banks issues new base money (M0) the money comes to banking system in form of deposits. Then banks keep a very small part of it as reserves and rest they lend it out. What they lend out again comes back to them as deposits and again part of it is kept as reserves and rest is lent out. This process goes on if there is sufficient demand for loans and total money generated in the system would be much larger than M0 (issued by the central bank) as bank deposits are treated as money as well. So now the money demand would largely be demand determined and the behaviour of bank, and banks' borrowers (firm, and household) crucial in this process.

In real world, however, the situation is more likely to be a convex combination of the two. This means money supply process is partly controlled by the monetary authority (through the instruments of monetary policy) and partly by the money demand from firms and households. It has been observed that the monetary authority tries to accommodate the expansion in money demand in normal circumstances. However, in the situation of high inflation (or overheating) the central bank uses its control over the interest rate through the instruments of monetary policy available to it to stabilize the economy.