Money market equilibrium:

Now for the money market to be in equilibrium the demand for money should equal the supply of money, i.e. actual money holding or cash balances of the public should match the total needed or desired balances

Or Md = k.P.y + L(i) = M = Ms

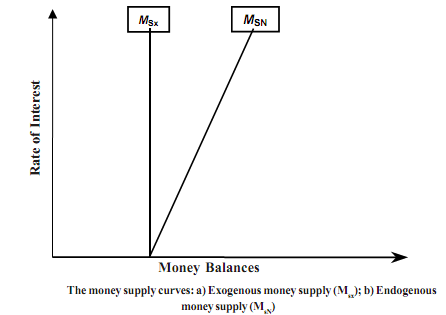

From this equation, it follows that combination of Y and i must be such that people's demand for money equals the supply of money by the monetary authority Thus as we see, according to Keynesian perspective, the rate of interest is purely a monetary phenomenon, determined by the demand for and supply of money. This is in sharp contrast to the classical QTM. For them rate of interest is a real variable determined by the commodity market by the equation between the supply of real saving & the demand for investment.

Next we bring the Md and Ms together to determine the equilibrium in the money market. Figure shows the Md and Ms schedule. The dynamics works through the rate of interest. At r1 there is excess demand for money as the interest rate is lower than the equilibrium level. This means there will be too many people holding on to money balances (mainly the speculative). Due to the imbalance between demand and supply there will be pressure on the interest rate to go up. But how will this happen? At lower rate of interest the demand is more than the supply which means the banks will be willing to offer a higher rate of interest to get deposits once that happens the money multiplier will raise the Ms and at higher rate of interest the money demand will go down and this process will go on till the equilibrium gets restored. The reverse will happen in case of rate of interest which is higher than the equilibrium interest rate.