Money and nominal income:

We start this section with the Quantity Theory of Money (QTM) which tried to relate the money with the nominal income. Then we will discuss the Keynesian perspective of the link between the money and other macroeconomic variables.

We start with some pure reasoning that goes back to a few hundred years. Like a lotof good theory, it's based on an analogy. As a start, you should ask yourself whatthe effect of a two-for-one stock split would be on the price of a stock. Suppose it'snow selling for 100, then you'd probably expect it to sell for 50 after a split, unlessthe split is an indicator of some new information about the firm. The point is that thevalue of the firm's stock shouldn't depend on anything as arbitrary as the number ofshares outstanding: its value is more fundamental than that.Now suppose we do the same thing with money. This is unrealistically simple(remember, we're doing theory now!) but suppose the government were to replaceevery rupee with two new rupees, marked so we can tell the difference between oldand new rupees. Then we'd expect that prices in terms of new rupees would betwice as high. In short, changes in the money supply executed in this way will beassociated with proportionate changes in prices, with no effect on output oremployment.

Of course the world is more complicated than this, and monetary policy consists ofmore than just currency exchanges, but some of the same reasoning applies moregenerally (or may apply, we'll look at some data shortly). The so-called quantitytheory of money is the result of two ideas: that money is not fundamental (pieces ofpaper don't change the effectiveness of Tata Steel's manufacturing processes ormarketing strategies), and that its usefulness is in executing transactions. Let's startwith the latter. Suppose we think of Y as all the transactions in the economy and PYis the rupee value of all these transactions (sales revenue). Then we need M rupeesof money to make all these transactions each period, or

M=P.Y

Note that this equation has the stock-split property: if we double M then we doublePY. We can make this more specific by associating transactions Y with real GDP,PY with nominal GDP, and P with the GDP deflator.

A slight generalization is that money can be used several times each period fortransactions, as it goes from one person to another. That is,

M V = P . Y

where V is the velocity of money, the number of times each period a unit of moneyis in a transaction. The assumption of the quantity theory, which dates back to aboutthree hundred years, is that velocity is approximately constant. This equation maintainsthe stock-split property that increases in M are associated with proportionate increasesin PY.

In principle the increase in PY could be in either in P, or Y, or both. Later we'llconsider a theory in which Y changes are possible (the Keynesian theory). But fornow let's say that Y is not affected by changes in M. The theory behind this in ourcase is that Y has been determined by the production function and the labor market.That leaves only one thing to adjust when M changes: the price level P. In short,changes in the stock of money lead, in this theory, to proportionate changes in prices.

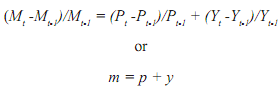

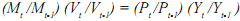

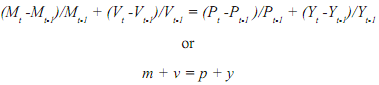

The same theory can be reinterpreted in terms of the inflation rate, the rate of growthof the price level. To see this, we need to covert the quantity theory relation togrowth rates. We take the quantity equation at two different dates and divide, getting

For reasons similar to our growth accounting relations mathematically we couldwrite it as

Where lower case characters represent the rate of growth of upper case variables(i.e, for example m refers to the rate of growth of money M and so on for v, p andy respectively).If velocity is constant [(Vt -Vt-1)/Vt-1 = 0] we get, approximately, the growthrate of money equals the growth rate of prices (inflation) plus the growth rate of output