Milton Friedman's Modern Version of QTM:

Milton Friedman, a Chicago economist, Nobel Laureate, made a restatement of the QTM and referred to it as Monetarism or the New Quantity Theory. Friedman's theory of the demand for money is partly Keynesian and partly Classical (or non- Keynesian). The classical QTM is basically a theory of the general price-level. It is also a theory of money income determination. For Friedman, however, it is primarily a theory of the demand for money. It is non-Keynesian in the sense that Friedman neglects completely Keynes' classification of the motives for holding money and the corresponding component demands for money.

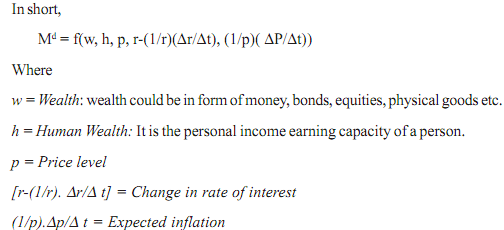

In the Classical macroeconomics, role of money is emphasised as a medium of exchange. Friedman, in his version of the theory, regards money as an asset or a capital good also (similar to Keynes' theory). According to him, wealth can be held not only in the form of (i) money; and (ii) bonds; as analysed by Keynes, but also in the form of (iii) equities, (iv) physical goods (durable and semi-durable consumer goods, structures and real property); and (v) human wealth (h). Human wealth as embodied in human beings in the form of their potential to earn income.

Total wealth is one of the key determinants of Friedman's demand for money. In practice, it is very difficult to estimate, especially the wealth in human form. He, to overcome this problem took permanent income as an approximation for wealth.

According to him, the expected rates of return on various forms of wealth, w, was the key determinant of the demand for money.