Keynesian Perspective using the IS - LM Framework:

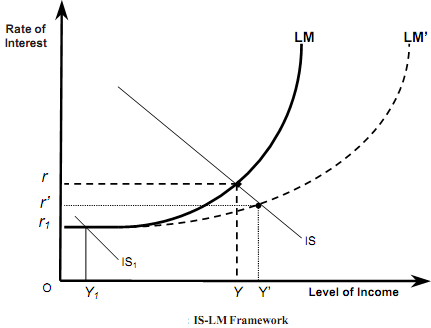

Sir John Hicks in 1937 tried to capture the essence of Keynesian analysis using the now famous IS-LM framework. This basically tries to bring the goods and money market together to determine the equilibrium in the economy. The IS curve indicates the different level of rate of interest and level of income where the goods market is in equilibrium. The LM curve on the other hand shows the different level of rate of interest and level of income where the money market is in equilibrium. The shift in IS curve happen by the changes in fiscal policy (not shown here) and shifts in the LM curve by the monetary policy. Let us concentrate on the money for the time being, we find that the expansionary monetary policy would shift the LM schedule to the right (from LM to LM' in the figure) and as a result the rate of interest will fall (from r to r'). Once the rate of interest falls there will be an impact on the real economy through the investment spending (there will be movement along the IS curve). So investment in the economy will go up and through the multiplier impact the level of income in the economy will go up from Y to Y'.

As one could notice from the figure at the interest rate r1 most people in the economy feel it to be at the lowest and expects it to rise, in this situation the monetary policy is ineffective as the interest rate cannot go down any further so the level of income remains unchanged. It is believed that this has been one of the main reasons responsible for the persistence of Japanese recession and earlier in our discussion in this Unit we described it as the problem of 'liquidity trap'. Here the same phenomenon shows off as the horizontal part of the LM schedule. We could notice that if the LM curve shifts there is the level of income remains unchanged at Y1.

So we see in this perspective inspired by Keynesian theory there is strong link between the real and monetary sectors of the economy. The evidence does seem to indicate that the Keynesian perspective to be closer to the empirical evidence.