The Keynesian Perspective on Money:

This theory was formulated originally by Keynes in his famous book "The General Theory of Employment, Interest and Money" Published in 1936. To understand Keynes theory two questions need to be separated:

a) First, why is money demanded?; and

b) Second, what are the determinants of demand for money?

Both these questions are inter-linked. According to Keynes, demand for money has three components: transactions demand for money, precautionary demand for money, and the speculative demand for money.

Keynes made the demand for money a function of two variables: namely

i) Money income, or Y; and

ii) Rate of interest, or r;

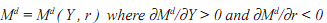

In functional form:

Keynes retained the Cambridge approach to the demand for money under which demand for money is hypothesised to be a function of nominal income. But, according to him, this only explained the transactionary demand for money & Precautionary demand for money and not the entire demand for money. The revolutionary insight of Keynes has been the speculative demand for money component. Through it Keynes made this part of the demand for money a declining function of rate of interest, which is purely a monetary phenomenon and solely influenced by the monetary influences in the economy. The speculative demand for money arises from the speculative motives for holding money. This arises from changes in the rate of interest in the market and uncertainty about them.