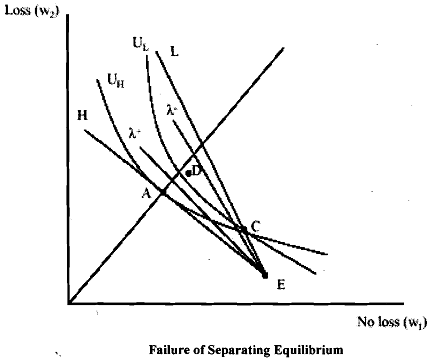

Separating Equilibrium:

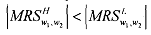

We have seen above that the pooling equilibrium is not feasible. Therefore, let us consider a 'separating equilibrium' instead. For that purpose, it will be useful to examine Figure. In the figure we have Just as in case of the pooling equilibrium two fair odds line corresponding to the two different risk groups. Points AL and AH give full-insurance points for the two risk groups. Group I, has higher wealth because its odds of experiencing a loss are lower. In the figure, C on the fair odds line is for the L group. The indifference curve from the full-insurance point for the H group crosses the fair odds line for the group L at this point. Moreover, the indifference curve U1* that intersects point C is steeper than the corresponding curve for the group H. Thus, we have

as has been shown earlier.

On the basis of the Figure, we can make the following observations concerning the two groups, H and L:

i) C is the best policy the insurance company could offer to the L types that would not at the same time attract H types.

ii) If the company offers the policy C+ on the figure to L types, they would strictly prefer it. However, the problem with it is that H types would also prefer it. Such a policy therefore would produce a pooling equilibrium.

In addition, C+ involves cross-subsidy if H types take it because UH is the indifference curve for the fully-insured type H. If there is a point that H types prefer to full-insurance, it can only mean that the policy is subsidised.

iii) If the company offers a policy C-, H types would not select it. With such an offer, L types would strictly prefer the original policy, C.

Consequently, any policy like C- will be dominated by C. So, C in the figure defines the 'separating constraint' for types H, L. Any other policy that is more attractive to H types would result in pooling. In equilibrium, we get policies AH and C where type H chooses AH and type L chooses C. Both policies break even since each lies on the fair odds line for the insured group. In the equilibrium H risk types are fully insured and L risk types are only partly insured.

It is important to note that equilibrium arrived in the market is influenced by the preferences of H risk buyers. The insurance providers maximise the welfare of L risk buyers subject to the constraint that they don't attract H risk buyers. Despite the constraints imposed by the H risk types on L risk types, they are not better off. You have a solution where one group loses without gains to the other.