Price Determination in Sylos-Labini's Model:

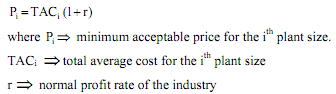

The price is set by the largest, most efficient firm. The equilibrium price must be such as to be acceptable by all firms in the industry and be at a level preventing entry. Given that the firms have different costs, there are as many minimum acceptable prices as plant sizes. For each plant, the minimum acceptable price is given by:

The price leader is assumed to know the cost structure of all plant sizes and the normal (minimum) profit rate of the industry. Given this information, the leader will set the price that is acceptable by the smallest, least efficient firms and will deter further entry. The price has to be such that, even the least efficient firm earns some profit. Otherwise, there could be government intervention, so that the leader has all the reasons to appease all firms, big and small. With all these considerations, given the market demand at the minimum acceptable price of the smallest least efficient firm, the price leader would set the price at such a level that post-entry the market price would fall below the minimum acceptable price.

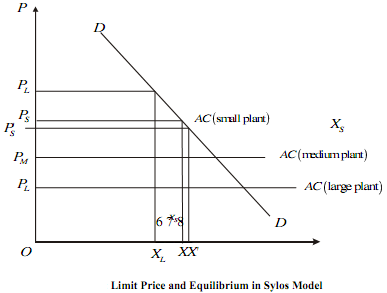

In the following diagram, the market demand at the minimum acceptable price PS of the smallest, least efficient firm is X. The leader will set the limit price PL > PS. PL corresponds to output XL. PL is the equilibrium price because it is acceptable to all firms, since at PL, all firms earn abnormal profit. Secondly, at PL, entry is deterred owing to the fact that post-entry output would be: XL + XS = X' whereby price would fall just below Ps the minimum acceptable price of the entrant (PS)

PL is indirectly determined by the determination of the total output that the established firms will sell in the market. The leader determines the output at which all established firms use their plants upto capacity. Next, the leader determines the total output XL to be sold, so as to prevent entry. XL has to be such that, once the entrant enters with output Xs (since by assumption, she enters with the smallest plant size), the total supply in market would exceed X. The price would fall below PS, which is the minimum acceptable price of the least efficient firm in the industry. The entrant being a small firm would incur a loss. Now given XL, the limit price PL is determined from the market demand curve. It is to be noted that any output smaller than XL will not

prevent entry.

In Sylos model the determinants of PL are:

a) The absolute size of the market X.

The larger the market size the lower would be the entry-preventing price.

b) The elasticity of market demand.

The more elastic the demand the lower is the price that the established firms can charge without attracting entry.

c) The technology and technical change.

The larger the minimum viable plant size, the higher will be the limit price.

d) The prices of factors of production

An increase in the factor prices will lead to an increase in the costs and the limit price in the industry.