Rate of growth of capital supply (gc):

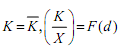

According to Marris, the main source of finance for growth is the profit. Therefore, he assumes gC is proportional to the level of profit,

where  = the financial security coefficient

= the financial security coefficient

π = level of total profits.

model  is assumed to be constant and exogenously determined in this model.

is assumed to be constant and exogenously determined in this model.

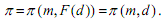

Now,

since an increase (decrease) in average profit margin results in an increase (decrease) in total profits, given

since an increase (decrease) in average profit margin results in an increase (decrease) in total profits, given

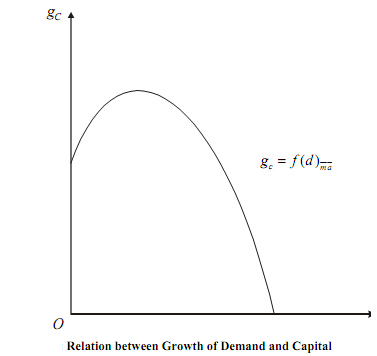

The relation between X and d is such that, initially it reaches a maximum and hen falls. This is evident from the fact that initially as d increases X increases owing to better utilisation of the managerial team and R&D. This happens up o an optimum level of d. Beyond that as d increases, efficiency falls and X decreases Therefore, the profit function is modified to,

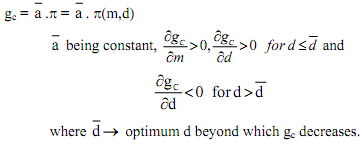

Accordingly, the gC function becomes,

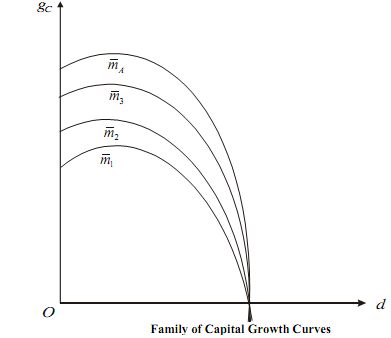

The relation between gC and d, keeping a and m constant, is shown in Figure. Allowing for both d and m to vary, we obtain a family of gC curves, for a given a , as shown in Figure. The higher the m, the higher is gC.