Debt Servicing and Tax Burden:

Public Debt is to be serviced by paying interest charges. Tax raised to pay the interest payments impose a burden on the economy. The taxes which are necessary to be imposed to finance the interest payments places a burden on the economy. Following R.A. Musgrave and P.B. Musgrave the additional tax burden can be measured with the following equation.

Where i is the interest rate and d is the ratio of debt of national income Y. If i equals to 5% and d equals to 40% t equals 2%. If d rises to say 100% t increases to 5% and if d rises to 500%, t increases to 20%. In an economy having the above mentioned conditions, if required 't' for financing other public services is 20% the corresponding total levels of 't' would be 22%, 25%, and 40% respectively.

E.D.Domar, an American economists defined the burden of public debt 'as the ratio of the total debt to the national income'. He stated that the problem of debt is essentially the problem of achieving a growing national income increase. If the national income grows, taxation required to finance interest liabilities on public debt would not impose an unbearable burden on the economy. According to him, the conditions under which the burden would increase or decrease over time is as follows.

Let D = amount of debt outstanding at the beginning of a year.

i = rate of interest paid on debt.

T = amount of taxes necessary to cover the interest charge on debt.

So T = Di

t = fraction of income (Y) taken through tax to pay interest.

t = T/Y Di/Y = i*D/Y

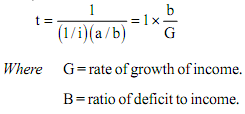

It may be explained from the above equation that the tax rate necessary to pay interest on debt depends on the ratio of the size of debt multiplied by the rate of interest to income. This tax rate may be related to growth of income and the budget deficit which can be stated in the following equation.

The increase or decrease of the burden of debt can be shown by the above equation.