Firm at the Long-run: Choice of Plant and the Adjustment Process:

In the long-run, an entrepreneur can adjust the plant size. She has the scope to choose the optimal plant size, which would minimise the cost. The adjustment process is illustrated with the help of the following diagram.

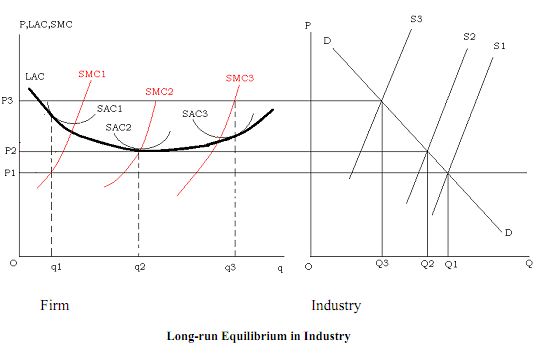

Let the market price be OP. The firm has a plant size whose costs are represented by short-run average cost (SAC1) and short-run marginal cost (SMC1). With this plant size, the short-run equilibrium occurs at a point where the firm produces oq1 amount of output. The firm makes a loss because the price line lies below the SAC1 curve. In such a situation, the firm has two options: to go out of business or to construct a plant of more suitable size.

In the long-run, the firm has the option of increasing the plant size so that it would construct a larger plant represented by SAC2 and SMC2 in the diagram. At the price OP, the firm with this new plant size would produce Oq2 amount of output, which would give it some profit. With perfect knowledge about the future, the firm would decide to use the plant represented by SAC4 that gives it the most profit.

The long-run adjustment process and the choice of plant for the firm are shown in the figure below.

Suppose initially price is OP1 and the firm has only the plant 3 represented by SAC3. Setting P = SMC, it produces Oq3 and earns some profit because OP3 > SAC3. As the firm is earning some profit, new ones would be attracted into the industry. As a result, the supply in it would go up from OQ3 to OQ1 and price would fall from OP3 to OP1. Consequently, the supply curve would shift from S3 to S1.

At price OP1, the representative firm is making a loss because OP1 < SAC1. Therefore, the existing firms would start moving out of the industry. As a result, the supply in the market would fall and the supply curve would shift backward from S1. Given the market demand curve DD, as the supply curve shifts, the price would fall. Suppose the price settles at OP2. At this price, P2 = SMC2 = SAC2 so that the representative firm faces neither a loss nor a gain.

The new firms neither would have any incentive to enter the market nor would the existing firms want to leave the industry. Hence, this would be the equilibrium situation with OP2 price and OQ2 output in the industry. The corresponding equilibrium output for the firm is Oq2.