Time value of money:

We usually prefer to consume in the present than in the future. A rupee today is psychologically worth more to us than a rupee tomorrow. This is even truer when inflation is present. Investors will postpone current consumption and invest only if their future opportunities are larger due to the investment. Since one can invest money and start earning interest immediately, a rupee today must be worth more than a rupee tomorrow. Investors are investing money and getting returns in the future in terms of money. This is called cash flow. When cash comes to us it is called a cash inflow and is considered a positive cash flow, and when we pay out cash it is called a cash outflow and is considered a negative cash flow.

We will discuss in detail the consumption-saving choice and the investment decisions that lead to the demand for and supply of loanable funds in the next section, but for now we will be setting out some basic mathematics for the computation of interest rates and cash flows.

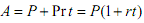

Let us begin by compounding a single cash flow. Suppose you invest Rs. 100 in 2007. if this investment earned simple interest at the rate of 10% per year, the future value of your investment would be Rs 100 plus Rs 10 per year for every year that the amount was invested at 10% per year. If you invested Rs 100 for 4 years you would have Rs 140 at the end of 4 years. In general if you invest Rs P (P stands for principal) at r% per year for t years, at the end of t years you will get an amount