Internal rate of return:

A bond's yield is the interest payment implied by the payment structure. The yield of a bond is that value of the rate of return (shown by r in our formulation-in the context of yield, we will later in the unit, on occasion denote it by 'y') for which the current price of the bond is equal to the present value of the bond's stream of payments (coupon and face value). This yield is also called yield to maturity. In the context of investment in general, yield is also known as the internal rate of return (IRR). The IRR of a bond is its yield. A basic property of a bond is that its price varies inversely with yield. This happens because as the required yield increases, the present value of cash flow decreases. There is another type of yield called the current yield, which relates the annual coupon interest to the market price. It is expressed as equal to annual interest/price.

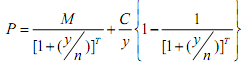

Let us give a formulation for the yield to maturity that will help us in understanding the concepts of maturity and duration that we will come across later in the unit. This is just an extension of the second equation above. Let there be a bond with a face value M that makes n coupon payments of C/n each year, and let there be T periods remaining. The coupon payments sum to C in a year. Let P be the current price of the bond. Then the yield to maturity is the value of y such that

This equation must be solved for y to determine the yield. Usually for T > 2, it is difficult to solve explicitly for y and it is solved through trial and error.