Tariffs:

A tariff or import duty essentially alters the relative prices of traded goods vis a vis non-traded goods in the domestic market. Tariffs may be specific or ad valorem. Specific tariffs are levied as a fixed amount per unit of the good. While, ad valorem duties are levied as a fixed percentage of the total value of the goods (e.g., 30% duty on imported computer parts).

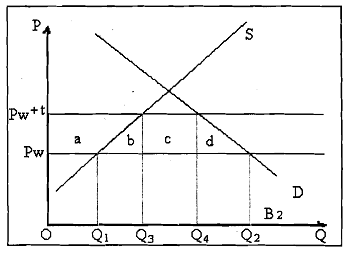

Using Figure, we will cany out a simple cost-benefit analysis of the impact of a tariff on various economic agents like consumers, producers and the government in a partial equilibrium framework. We assume that the country is a small open economy that cannot affect world marketprices. The implication of this assumption is that the tariff leaves world market price of the good unaffected, while raising its price.in the domestic market.

In the Figure above we consider the domestic demand and supply curves of the imported good. The world market price of the good is Pw, and this is the price that would prevail in the domestic market under fiee trade. Thus with free trade, domestic production of the good would be Q1, domestic demand Q2, and the difference Q1Q2 would be imported. A specific tariff rate of per unit drives a wedge between the world price and domestic market price of the imported good. Post-tariff, price in the domestic

market rises to (Pw + t). As a result, domestic production increases from Q1 to Q2, while consumption falls from Q2 to Q4. Now let us consider the costs imposed by the tariff. Owing to the tariff, domestic consumers suffer a loss in consumer surplus equal to the area (a + b + c + d), compared to free trade. This loss arises because consumers must now pay a higher price (Pw + t) for the good and also because they now consume Q4Q2 amount less of the good than with free trade. However, domestic producers gain from the price rise, with the area a representing the increase in producer surplus. The government also gains from the tariff as it earns a revenue. The imports are now Q3Q4 units, each paying a tariff oft per unit, so the tariff revenue is given by the rectangle with area c. Clearly the loss to consumers exceeds the gain to producers and the government taken together, indicating that the tariff results in a net social loss to society equal to the sum of the areas b and d.

In Figure:

Area b measures the loss in social welfare from the production distortion due to the tariff. It represents the higher cost of producing Q1Q3 domestically rather than importing this amount; Area d is the welfare loss due to the consumption distortion created by the tariff. It represents the cost ofnot consuming Q4Q2, an amount whose value to consumers exceeds the cost of importing it.

You should note that our partial equilibrium analysis of the impact of a tariff, focuses simply on the market for the imported good. Repercussions on a number of important issues like terms of trade, BOP, factor markets etc., are left out of this framework, as in case of our analysis of the benefits of free trade.

In particular, our analysis does not attach any weight to employment in the sector being granted tariff protection. If the import-competing sector accounts for a significant share of total employment, the measures of welfare loss would have to be adjusted accordingly. In reality, employment is often the most important reason underlying the imposition of protectionist trade policies.