Breadth of the Financial System:

Data on the financial breadth or penetration often serve as proxies for access of the population to different segments of the financial sector. Well-functioning financial systems should offer a wide range of financial services and products from a diversified set of financial intermediaries and markets. Ideally, there should be a variety of financial instruments that provide alternative rates of return, risk, and maturities to savers, as well as different sources of finance at varying interest rates and maturities. Evaluating the breadth or diversity of the financial system should, therefore, involve identifying the existing financial institutions, the existing markets for financial instruments, and the range of available products and services. The relative composition of the financial system discussed above is a first-cut approach to determining the extent of system diversification. In addition, comparisons between bank and non-bank forms of financial intermediation are useful, for instance, comparisons between banking credit and issues of bonds by the private sector. Often, significant savings and financing through non-bank forms are indicators of financial diversity because bank deposits and loans constitute the traditional forms of savings and credit in many countries. It is, therefore, useful to compare the extent of financial intermediation through banks with the amount of intermediation through insurance, pensions, collective investment schemes, money markets, and capital markets. In particular, the share of various classes of asset holders-specifically, households, non-financial corporations, banks, and NBFIs-within the total capital market instruments or mutual fund assets can provide valuable information on financial diversification.

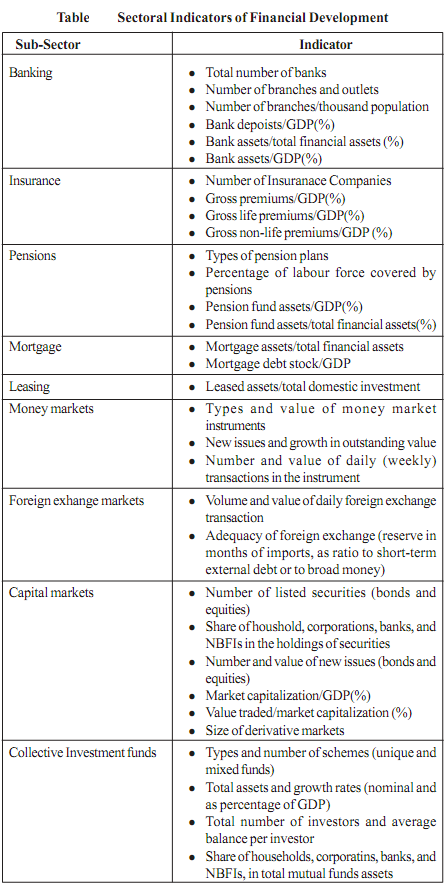

To supplement the overall indicators of diversity, assessors should also focus on sectoral indicators of financial development. For instance, the development of the insurance industry could be measured by examining trends in the ratio of gross insurance premiums to GDP, which could be broken down further into life and non- life premiums. Similarly, leasing penetration could be measured by the value of leased assets as a percentage of total domestic investment. Table shows a few sub- sectors of the financial system and suggests relevant indicators of their size and development. The breadth of the financial system also could be analyzed in terms of the outreach of existing financial institutions. A common indicator related to this outreach is the branch network of the banking system, in particular, the total number of branches and the number of branches per thousand inhabitants.

A comparison of the distribution of branches between rural and urban areas or among different regions/ states/provinces could also be useful as an indicator of the outreach of banking outlets.