Natural Monopoly:

A natural monopoly is referred to a market structure, where a single firm is the only supplier of a particular kind of product or service due to the fundamental cost structure of the industry that precludes another entry.

Natural monopolies are often contrasted with coercive monopolies, in which competition would be economically viable if allowed but potential competitors are barred from entering the market by law or by force. Natural monopolies arise where the largest supplier of an industry, or the first supplier to a local area, has an overwhelming cost advantage over other actual or potential competitors. This tends to be the case in industries where capital costs predominate creating economies of scale, which can be reaped at an output level large enough in relation to the size of the market. Such high costs create barriers to entry. Examples of these types of industries include water services and electricity. It may also depend on control of a particular natural resource. Companies that grow to take advantage of economies of scale often run into problems of bureaucracy; these factors interact to produce an "ideal" size for a firm at which its average cost of production is minimised. If that ideal size is large enough to supply the whole market, then that market is a natural monopoly.

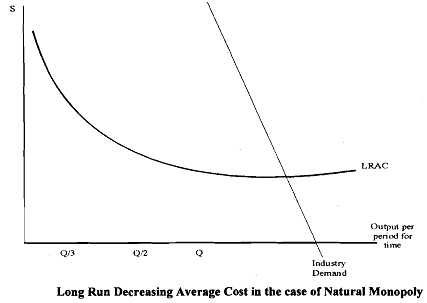

A natural monopoly occurs in a market where the average cost curve is decreasing over the entire relevant range of outputs. In Figure, a typical "U" shaped long-run average cost curve (LRAC) is shown. It reflects the common tendency for average costs to first fall then rise as output increases. In the case of a natural monopoly, the entire relevant part of the LRAC curve (that is, the range of outputs where demand for the product exists) is downward sloping. If a single company supplies the entire market, the output it produces will correspond approximately to the amount Q. If two firms supply the market, each firm will produce approximately Q/2, and if there are three firms, each will produce Q/3. The more firms in the industry, the less each firm will produce, and the greater will be the cost structure for each firm.

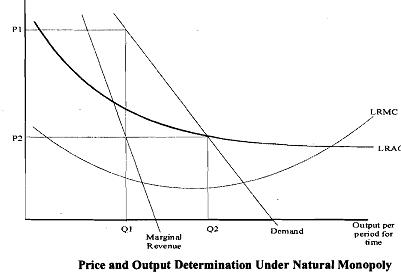

If a natural monopolist were free to set prices or output levels, it would tend to produce approximately Ql units of output and charge a price of about PI. This price and quantity combination is considered sub optimal by most economists: as the diagram suggests, it creates windfall profits for the monopolist and also generates less than socially optimal quantities of the good (that is, less product than would be demanded if the price was lower). It also creates what economists calk a "dead-weight loss" to society. For these reasons, governments tend to restrict the prices that a natural monopolist can charge. Typically, governments set the price at P2 (determined by the largest quantity of output that the market demands and that can be produced profitably)