Imperfect Competition:

Imperfect competition is one of the standard examples of market failure, which leads to the non-achievement of Pareto optimality. It is on this basis that economic policy is usually suggested as necessary to reduce in efficiency. Forms of imperfect competition include:

- Monopoly, in which there is only one seller of a good.

- Oligopoly, in which there is a small number of sellers.

- Monopolistic competition, in which there are many sellers producing highly, differentiated goods.

- Monopsony, in which there is only one buyer of a good.

- Oligopsony, in which there'is a small number of buyers.

There may also be imperfect competition in markets due to buyers or sellers who lack information about prices and the goods being traded. There may also be imperfect competition due to a time lag in a market. For example, in the 1990s, there was a shortage of computer programmers as becoming a skilled programmer requires several years of experience the shortage of such skilled personnel continued. Another example is the "jobless recovery". There are many growth opportunities available afier a recession, but it takes time for employers to react, which would result in gainful employment. Hence high unemployment persists.

To demonstrate that imperfect competition fails to generate a Pareto optimum, it is necessary to provide a suitable characterisation of Pareto optimality.

There are several ways in which this can be done. First, by consideration of the competitive equilibrium it can be appreciated that competitive firms price at marginal cost which is one of the conditions for Pareto optimality. In contrast, price will not be equal to marginal cost in the imperfectly competitive industry. A second method of comparison is that at a Pareto optimum, the ratio of shadow prices for any pair of goods is equal to the ratio of market prices. But for the economy with imperfect competition, assuming that there is a single firm in each imperfectly competitive industry, prices are not proportional to the marginal rates of transformation, which captures the social cost of producing each good. In addition, the imperfectly competitive firms take the effects of their actions upon prices into account, which eliminates the direct proportionality.

The imperfectly competitive equilibrium cannot maximise the value of any social welfare function that satisfies the Pareto criterion. This observation then makes it natural to consider what the degree of welfare loss may actually be, either for a real economy or for simulated examples. The assessment of monopoly welfare loss has been a subject of some dispute in which calculations have provided a range of estimates from the effectively insignificant to considerable percentage of potential welfare.

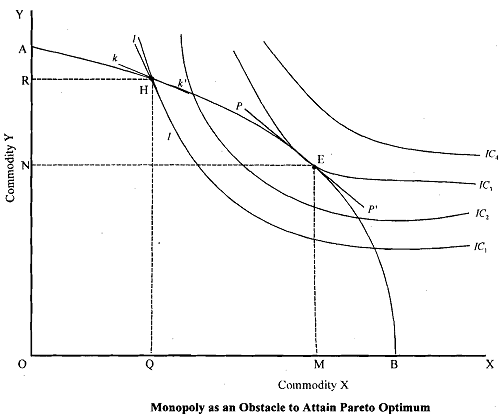

That monopoly causes loss of welfare and misallocation of resources will become clear by considering the following Figure. It will be seen from the figure that the transformation curve of the community AB is tangent to the community indifference curve IC3 at point E. Therefore, at point E MRTxy of the community is equal to the MRSxy, Thus, E represents maximum possible level of social welfare and the combination of two commodities being produced represents optimum allocation of resources. But

when the commodity X is being produced under conditions of monopoly, the equilibrium will be at H, not at E .

This is because, under monopoly, producers would be equating MRT or the ratio of marginal costs with the ratio of marginal revenues and not with the ratio of prices of two goods. Since consumers would be equating MRS with the price ratio of two goods, the MRT in the equilibrium position at point H will not be equal to the MRS. This is quite obvious from the figure where at

point H transformation curve AB and consumers indifference curve IC1 are intersecting. This implies that the slopes of transformation curve at point H, which indicates MRT and the slopes of consumer's indifference curve IC2, which indicates MRS, will not be the same. It will be observed from the figure that at point H, MRS is greater than MRTxy as tangent ll' drawn to point H on IC1 is steeper than the tangent kk' drawn to point H on the transformation curve AB. This means that consumers' preference is that good X should be produced more but because of the existence of monopoly in the production of commodity X, it is not being produced to the desired quantity.

As a result, the level of satisfaction or welfare of the consuming community is at a lower level than possible under the given production conditions. Thus, monopoly has caused misallocation of resources.