Symmetric Information: First Best Option:

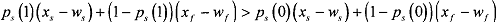

Start with the assumption that the principal is able to verify the agent's action. He can therefore "force" the agent to choose e = 1. The contract that can be offered by the principal is (e = 1, w,, wf) consisting of a level of effort and a wage contingent on the project's outcome. The principal's expected utility (payoff) increases with the level of effort, since

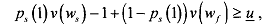

The agent will accept the contract if it yields an expected payoff at least as high as what she could get elsewhere, i.e.,

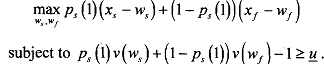

where g denotes the agent's reservation utility. If the wages w, and wf are not high enough. the agent will decline the offer and get g somewhere else. The principal's problem is to maximise his expected utility, subject to the agent's participation constraint (i.e., subject to the agent accepting the contract), that is,

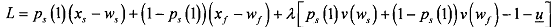

Now, we write the Lagrangian of the problem as

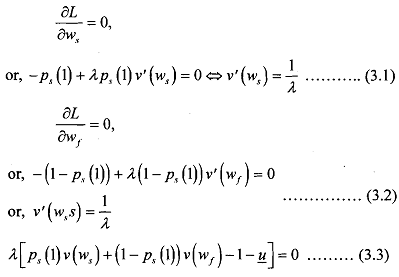

The FOC of this optimisation problem are

From the conditions and we write v'(wf) = 1/λ. Since we have assumed v" < 0, this equality can only be verified if w, = wf. When the agent is risk-averse and the principal is risk-neutral, he offers total insurance to his employee by offering a wage that is independent from the outcome of the project.

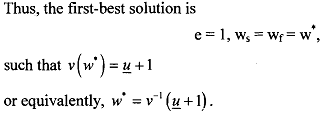

Thus, we get the first-best solution that a risk-averse worker if employed by a risk-neutral principal would get a wage independent of any contingency. If in the equilibrium, ws = wf = w*, the agent participation constraint is

This constraint must bind. Otherwise the principal could lower the wage offered w* by a small amount, without affecting the agent's participation, but thereby increasing his own revenue.