Asymmetric Information:

If we introduce the more realistic case where the principal cannot verify the agent's level of effort, we get the following result:

The principal offers a contract with a constant wage w', the agent will decide to bunk: because she minimises her cost. The principal cannot verify this. The principal anticipates such a behaviour, and chooses the wage accordingly. What he is trying to do is to offer a wage that maximises his expected profit, subject to e = 0.

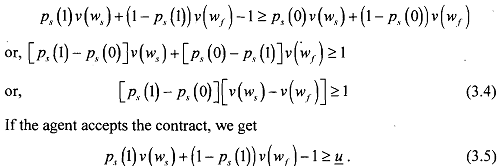

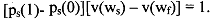

The principal can design a contract of the form (w,, wf), such that it pays for the agent when she actually works, i.e.,

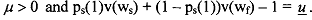

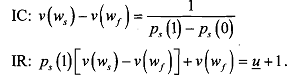

Thus, in order to get (w, - wf) increasing as (p,(l) - p,(O) decreases we must have from (3.4) above w, > w,. If there is success, the wage has to increase as its probability decreases towards p,(O). It becomes more difficult to distinguishsomeone who works from someone who bunks. It is easy to recall that condition (3.4) is incentive compatibility constraint (IC) we have seen earlier. The principal must give the agent an incentive to actually do the work. Such a design is compatible with the agent's preferences, such that when the agent maximises her objective function, she chooses the right level of effort.

The other condition (3.5) is participation constraint, or individual rationality constraint (PC or IR). It must be binding because otherwise, it would mean that the principal would decrease both w, and w, by a small amount E , which would not affect the IC constraint and would increase his expected payoff.

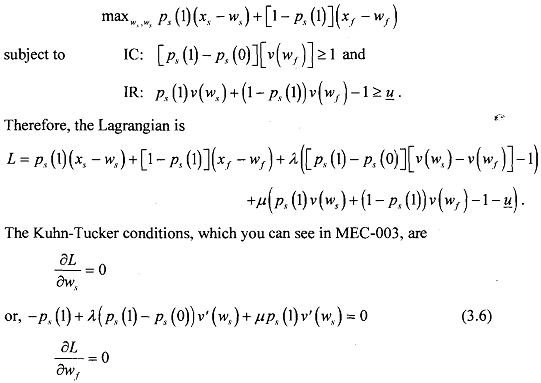

We can write the principal's optimisation problem as

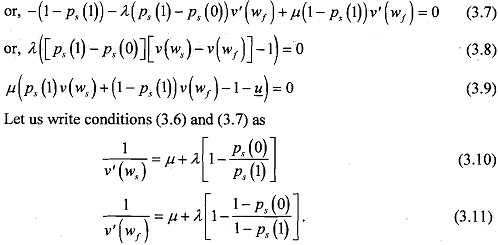

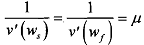

Now, we have to shown that both constraints, IC and IR are binding. Suppose IC is not binding such that L = 0 ; conditions (3.10) and (3.1 1) would then yield  and we get ws = wf. But then, v(ws) = v(wf) and 1C will not be satisfied. Therefore, we must have λ > 0, and

and we get ws = wf. But then, v(ws) = v(wf) and 1C will not be satisfied. Therefore, we must have λ > 0, and

Next, suppose IR is not binding such that p = 0. Condition (3.7) will not be satisfied as the LHS would always be negative. Therefore, you must have

With the constraint binding and p > 0, the payment in general to the agent will vary with the outcome. Thus, we have a situation where the principal desires the action which imposes high costs on the agent so the payment to px (0)

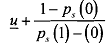

the agent will depend on the behaviour of the fraction

This ratio is called the likelihood ratio. It indicates the result x signals that the effort was high (i.e., e = 1). When the ratio is smaller, px(l) is higher with respect to px(O) and the signal that e = 1 is stronger. Use of the likelihood ratio for the construction of the optimal incentive scheme suggests that we can use regularity conditions found in statistics to solve the behaviouriable problem of optimal scheme. Let us return to our example of employer-employee above.

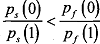

We have assumed that ws > wf. It holds if  . This implies, the ratio

. This implies, the ratio  decreases when the outcome x increases, just a statistical property, which we call monotonous likelihood property. Using the fact that IC and IR bind in the equilibrium, we can have

decreases when the outcome x increases, just a statistical property, which we call monotonous likelihood property. Using the fact that IC and IR bind in the equilibrium, we can have

Solving for v(w,) by substituting 1C and IR, we get v(ws) > v(wf)', (ws) =  . Since we know that the agent is not fblly insured, and her - P.7 (1) - (0) wage will decrease in case of failure. Note that this provides her an incentive to work.

. Since we know that the agent is not fblly insured, and her - P.7 (1) - (0) wage will decrease in case of failure. Note that this provides her an incentive to work.

In the above, we have tried to get the second-best situation where the principal cannot observe the action taken by the agent, but the outcome only. If the employee (agent) receives a constant wage, she will choose the effort which minimises her cost. Such an action, in general, will not be optimal. Solving the moral hazard problem, therefore, essentially implies that the employer (principal) offers the employee a contract that trade off risk sharing and incentives.

The optimal incentive scheme can take on very complicated forms. The factors, which influence the optimal incentive could be profit created by additional effort, precise assessment of desired activities agent's risk tolerance and response to incentives.