Entry deterrence:

Here we want to emphasise a topic, that essentially an application of two stage game of perfect information viz. entry deterrence. Consider a situation where there are two firms. Firm 1 is the incumbent firm who is already a monopoly in the market and firm 2 in the potential new comer who wants to enter into the market knowing the fact that firm 1 is already earning supernormal profit due to her monopoly power. Assume both firm produce homogeneous output. Also assume demand does not change over time. Now as firm 1 is a monopoly she can set the market price a she like. But if the newcomer firm enter then she knows that the market then become duopolistic. Assume that after the entry of the new firm both will play a Cournot Game. Then firm 1 no longer being able to continue her monopoly. Therefore considering all this firm 1 can do either of the following (1) she allow firm 2 to enter into the market and plays a Cournot Game or (2) she will decrease the price of her goods in such a way that if the new comer firm enter and plays a Cournot Game then the new comer firm will earn zero profit and therefore the new comer firm will never enter. The second case constitutes the case for entry deterrence. There are many reasons why firms go for entry deterrence; firstly due to economics of scale in presence of large fixed cost, secondly due to absolute cost advantage may be due to superior technology.

Definition: Limit Quantity (qL) is a quantity such that P(q+ qL) < C(q)/q for all q > 0, i.e. if the incumbent firm produce q~ then the potential entrance will make either zero profit or losses if she enter and produce any positive amount of quantity, where P(Q) is the inverse demand hnction and C(q) is the cost fbnction of the new comer firm.

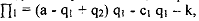

Definition: Limit Price (pL) is a price such that PL = P(qL) where qi is the limit quantity. Now consider the following situation - Inverse demand function of the market is given by p = a - q1 - q2, where ql is the quantity produced by the incumbent firm and q2 is the quantity produced by the new comer. Cost function of the incumbent firm is Cl(ql) = cl ql and cost function of the new comer is C2(q2) = c2 q2. Therefore, the profit function of the incumbent firm is given by

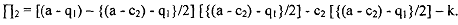

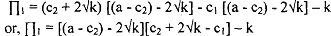

, where k is the fixed cost. Similarly, profit function of the newcomer firm is given by n2 = (a - q1 + q2) q2 - c2 q2 - k. NOW suppose incumbent firm allow the new comer to enter into the market and therefore after entering the market both the firms will plays Cournot game. Hence after entering the market both firms will earn Cournot profit of duopoly, which is given by

Now suppose the incumbent firm wants to deter the entry of the newcomer firm. Therefore, the incumbent firm should produce limit quantity. To find out the limit quantity we must find out a particular quantity such that if the incumbent firm produce that quantity and if the new comer firm will enter then for all positive quantity produced by the new comer firm at that price will result non-positive profit.

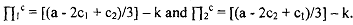

We know that the reaction function of the newcomer firm is given by - q2 = [(a - c2) - q2]/2. By putting this reaction function into the profit function of the newcomer firm we have

So, incumbent firm will produce such a q1 such that n2 = 0. Therefore, solving this equation we have q, = (a - c2) - 2√k. NOW if the incumbent firm will produce this amount of quantity the best response of the newcomer firm is to not enter in the market, and therefore producing zero output. So the total output in the market is ql. And therefore the price in the market is p = c2 + 2√k. Therefore profit of the incumbent firm if she wants to deter entry is

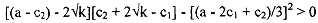

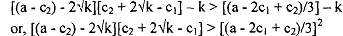

Now we know that the objective of the firm is to maximise her own profit and therefore the incumbent firm will deter entry of the new comer only if

Therefore, firm 1 (the incumbent monopoly firm) will deter the entry of the firm 2 (the potential new comer) if and only if