Ex Post (Historical) Risk:

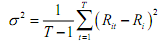

In investment analysis, basically risk is associated with variability of rates of return. Variability is usually measured as individual returns in relation to the average. In statistics, one of the basic measures of variability is the variance. The positive square root of the variance is the standard deviation, usually denoted by the lower-case Greek letter sigma (σ) .The variance (square of standard deviation) is defined as:

Thus the variance can be considered as the average square deviation from the mean return. To calculate the variance, we first calculate the mean return. Then the difference between the return for each period and the mean return is obtained. These deviations from the mean are squared and added together. This sum is divided by T - 1 (the total number of time periods minus one).

The standard deviation is the positive square root of the variance:

We can think of the standard deviation as the average deviation from the mean.