Ex Post (Historical) Return:

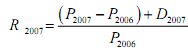

Let us begin with returns. Let R stand for the return from the asset, let P be its price, and assuming we are talking of stocks, let D be the dividend paid out on the stock. Then, the return from holding the stock in the year 2007, say, is given by

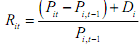

Thus, for stocks, the return for a particular time period is equal to the sum of the price change plus dividends received, divided by the price at the beginning of the time period. Assuming there are many stocks, we can have the general measure of returns for the ith stock, for the time period t-1 to t:

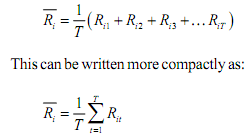

Suppose we are concerned only with the i th stock and are interested in obtaining a measure of historical performance of his stock, that is a measure of average returns on this stock over the time period t = 1, 2, ..., T. We get is straightforward arithmetic mean:

Of course, other than finding out the average returns over time for a single stock, we can as well obtain the average returns for several stock for a single time period. The method is the same, except that we aggregate over the number of shares rather than number of time periods. Let there be n shares: i = 1,2,3,...,n. Then

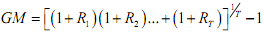

When we consider the average returns of a single share over several time periods it is better to use the geometric mean:

The concept of geometric mean is very closely related to that of compound growth rate, as for example, compound interest.