Ex Ante (Expected) Risk and Return:

We have discussed the return and risk of securities after the event (actual). But actually when an investor is contemplating whether to invest in a stock, she is certainly interested in the historical track record of the risk and return of that stock. But the investor is also interested in the future return of a stock. Thus expectations about future return and risk is very important for the investor. We describe the expectation about the future in terms of probability distributions. A probability distribution is just a listing of the various alternatives and the probability of each alternative occurring. if we roll a die, any one of the numbers 1 to 6 can turn up, each with a probability of 1/6. this is an example of discrete probability distribution. Probability distributions can also be continuous, as the normal distribution. In this case, we speak of probability of occurrence of a certain range of values, as the probability that a single value occurs is zero.

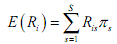

We use the concept of expected value when using probability distributions. Let us suppose there are different states of the world that affect the return of a stock (for example, booms or depressions, different economic policies etc) and that there is a certain probability of each state occurring. Let there be S states, indexed by s, that is, s = 1,2,3,...,S. Let πs be the probability of state s occurring.(probabilities of the different states sum to 1 since one of the states is certain to occur). Then if Ris is the return on the ith stock when state s occurs, the expected value of the ith share is:

Thus the mean (expected value) of ex-ante returns is just a weighted average of the conditional returns where the weights are the probabilities of the occurrence of the states of the world.

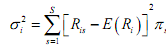

The variance of ex-ante data is computed according to the following formula:

The standard deviation is  Thus the standard deviation can be thought of as the weighted average of the potential deviations from the expected return.

Thus the standard deviation can be thought of as the weighted average of the potential deviations from the expected return.